What do we cover in this review?

In this annuity review, we will be covering the following details on the Pacific Life Pacific Index Advisory Fixed Indexed Annuity- Product type

Fees

Fees- Current rates

- Realistic long-term return expectations

- How this annuity is best used

- How it is most poorly used

Annuities can be complex. That’s where having an Annuity Investigator who loves math comes in. We make the complex, simple.

If you’ve been thinking about purchasing a financial product that can offer you security, along with an ongoing, lifetime stream of income in retirement, then the Pacific Life Pacific Index Advisory fixed indexed annuity could be a viable option for you. However, prior to running out and signing on the dotted line to purchase this product, it is important to first have a good understanding of just exactly how this annuity works, and how it may or may not fit in with your overall financial goals. Throughout the past several years, fixed indexed annuities have become much more popular with investors as a way of attaining potential growth and safety of principal, while also allowing for a guaranteed future income stream down the road. Due in large part to this increased popularity, many insurance carriers have been expanding their lineup of annuities – many of which offer a lot of bells and whistles. This, however, is not necessarily a good thing, as oftentimes, an already confusing product can be more confusing – even for well-educated consumers and financial advisors.

Annuity and Retirement Income Planning Information that You Can Trust

If this is your first visit to our website, then please allow us to officially welcome you here to AnnuityGator.com. We are a team of annuity pros who focus on offering very comprehensive – and unbiased – annuity reviews. We have been at this for quite a few years now – longer than our competitors. And, because of the in-depth reviews that we provide, we have become a highly trusted source of annuity information online. Over the past decade or so, however, there have been a number of “copycat” websites that have popped up on the Internet. While some of these can give you information about annuities, what you are likely to find is that they are oftentimes just simply reiterating what our information already shows. You may also have attended an annuity seminar in the recent past, where in return for a free lunch or dinner, you allowed the presenter to explain in more detail how the Pacific Index Advisory annuity from Pacific Life operates. But, while there are many, many sources of annuity information that may be found on the Internet today, a lot of these websites will just simply attempt to lure in visitors by making some fairly bold claims, like the following:- Highest annuity payouts

- Lowest fees

- Guaranteed income for life

- Top-Rated Annuity Companies

- Get an Annuity Quote Now!

Pacific Life Pacific Index Advisory Fixed Indexed Annuity at a Glance

| Product Name | Pacific Index Advisory |

|---|---|

| Issuer | Pacific Life |

| Type of Product | Fixed Indexed Annuity |

| S&P Rating | AA- |

| Phone Number | (800) 772-4448 |

| Website | www.pacificlife.com |

Opening Thoughts on the Pacific Life Pacific Index Advisory Fixed Indexed Annuity

Pacific Life Insurance Company has been helping clients to grow and protect wealth for nearly a century and a half. Throughout the years, this insurer has grown and expanded, both in terms of client base and assets under management. The company held approximately $158 billion in total assets as of year-end 2017, as well as more than $11.2 billion in equity. With more than $9.4 billion in operating revenues and operating income in excess of $774 million, Pacific Life is more than able to uphold its promises to policyholders. Because of its strong financial footing, as well as its timely payout of policyholder claims, Pacific Life has earned high ratings from the insurer rating agencies, including the following (as of 2018):- A+ (Superior) from A.M. Best Company

- A+ (Strong) from Fitch Ratings

- A1 (Good) from Moody’s Investor Service

- AA- (Very Strong) from Standard & Poor’s

Before we get into the gritty details, here are some necessary legal disclosures…

This is an independent annuity product review. It is not a recommendation to purchase or to sell an annuity. Pacific Life has not endorsed this review in any way, nor do we receive any type of compensation for providing this review. This annuity review is meant solely to be an independent review at the request of our readers so that they may see out perspective when breaking down the positives and the negatives of this particular annuity. Before purchasing any type of insurance and/or investment product, it is important that you do your own due diligence, and that you consult a properly licensed professional if you should have any specific questions that relate to your individual situation. All of the names, marks, and materials that were used for this annuity review are the property of their respective owners. For more information on how to compare annuities in order to determine which one may be the best for you and your financial circumstances, click here to obtain our free annuity report.How Pacific Life Describes the Pacific Index Advisory Annuity

According to its product brochure, the Pacific Index Advisory annuity is a deferred, fixed indexed annuity that helps you to:- Protect principal

- Have the opportunity for growth, based on the positive movement of the underlying index, and

- Generate guaranteed lifetime retirement income

To check out some case study examples of how the Pacific Life Pacific Index Advisory annuity can work, based on various investors’ objectives, you can view the entire product brochure HERE.

To check out some case study examples of how the Pacific Life Pacific Index Advisory annuity can work, based on various investors’ objectives, you can view the entire product brochure HERE.

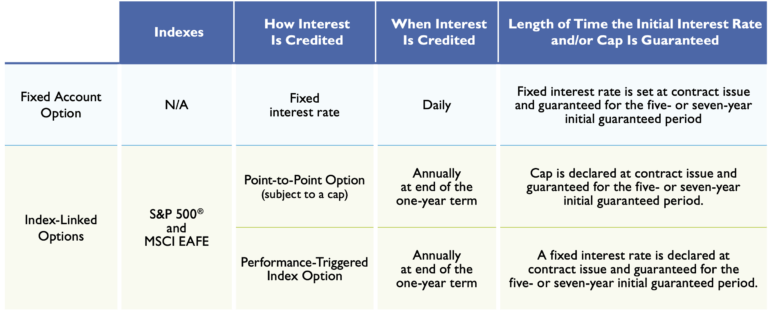

How an Insurance or Financial Advisor Might “Pitch” this Annuity

Given the “best of all worlds” features of fixed indexed annuities, it is likely that a financial advisor would pitch this annuity as a way to obtain a higher return than that of a regular fixed annuity, while at the same time a vehicle that provides principal protection if the underlying index that is being tracked has a negative performance. As with other annuities, the Pacific Index Advisory FIA from Pacific Life allows the money that is in the account to grow on a tax-deferred basis – and, provided that the lifetime option is chosen, it can also offer an ongoing income in the future that will last for the remainder of your lifetime, regardless of how long that may be. This can help to alleviate the worry about outliving your retirement income. But here again, even though tax-deferred growth, no loss due to market conditions, and guaranteed lifetime income can all make it sound like this annuity offers the best of all possible worlds, there are some tradeoffs that you may need to make in return for these features. Just some of these can include a cap on growth, as well as the inability to access more than just 10% of your contract value during the surrender charge period.What are the Fees Associated with Pacific Life’s Pacific Index Advisory Annuity?

While there are no up-front sales charges with this annuity, you could run into a significant penalty if you opt to withdraw more than 10% of the annuity’s contract value during its surrender charge period – which, by the way, runs for seven years under the seven-year rate guarantee, or five years with the five-year rate guarantee.Pacific Life Insurance Company’s Pacific Index Advisory Surrender Charge Schedules

| Year: | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8+ |

|---|---|---|---|---|---|---|---|---|

| 5-yr Rate Guarantee | 7% | 6% | 5% | 4% | 3% | 0% | ||

| 7-yr Rate Guarantee | 7% | 6% | 5% | 4% | 3% | 2% | 1% | 0% |

The Annuity Gator’s End Take on the Pacific Life Pacific Index Advisory Annuity

Where it works the best: This annuity could be a good option for you if you are looking for:- Principal protection

- Growth potential, but without being invested in the stock market

- Tax-deferred growth

- Some access to your money (up to 10% per year during the surrender charge period)

- Lifetime income

- A death benefit for your beneficiary (or multiple beneficiaries)

- Want to fully participate in market gains

- Want or need to access more than 10% of your funds penalty-free within the first several years

- Do not intend to use the guaranteed lifetime income feature

In Summary

There are a multitude of important factors that need to be considered when you are trying to determine whether or not an annuity will be right for you – or even if any annuity is the best alternative for some of your retirement funds. If you are considering a fixed indexed annuity like the Pacific Index Advisory from Pacific Life, then you can be secure in knowing that your principal will be safe from the ups and downs of the stock market, as well as in that you will have a future retirement income that you can count on. But in reality, the only way to really know whether or not this annuity is right for you is to have it tested. We can do this for you providing you with an in-depth and personalized spreadsheet showing how the annuity may perform given your specific parameters. In going this route, you could find that it fits the bill for you – or, you may also find out that there may be some other products out there that work better for you and your particular situation. Likewise, if you have any additional questions that were not answered in this review, and/or if you would like some additional assistance in determining whether or not this is the right annuity product for you, then please feel free to reach out to us directly via our secure contact form here.Any Additional Questions? Did You Notice Any Mistakes?

We understand that this review was a bit on the lengthy side. However, when offering our annuity reviews, we would much rather “err” on providing “too much” information rather than not enough. That way, you will be in a better position to make a truly informed decision as to whether or not a particular annuity product is right for you. In addition, we also know that annuity information can change on a regular basis. So, if you noticed any details in this review that may need to be updated or revised, then please let us know that, and we will be happy to make any of the needed changes here. Likewise, if reading over this review caused even more confusion about this product, then please click here in order to let us know that too. We also realize that, just as any other area of the financial services world, information about annuities can change on a regular basis. So, if you happened to notice any mistakes or outdated information in this review, please let us know so that we can go in and make the necessary corrections. Would you like to see any additional annuities reviewed? If so, just let us know the name (or names) of the product(s) you would like to see reviewed via our website, and our team of annuity “geeks” will get on it asap. Best, The Annuity Gator P.S If you would like to read more of our Pacific Life annuity reviews here are some links to check out:- Independent Review of the Pacific Life Frontiers ll Fixed Deferred Annuity

- Independent Review of the Pacific Life Expedition Fixed Deferred Annuity

- Independent Review of the Pacific Life Secure Income Deferred Income Annuity as a QLAC

- Independent Review of the Pacific Life Core Protect Advantage Variable Annuity

- Independent Review of the Pacific Life Pac Mariner 7 Year Guaranteed Rate (MYGA) Annuity

- Independent Review of the Pacific Life Pacific Index Choice 6 Fixed Indexed Annuity

- Independent Review of the Pacific Life Pacific Frontiers II, 1 Year Guarantee Fixed Annuity

- Independent Review of the Pacific Life Pacific Odyssey Variable Annuity

- Independent Review of the Pacific Life Pacific Index Foundation Fixed Indexed Annuity

- Independent Review of the Pacific Life Pacific Index Edge Fixed Indexed Annuity