Updated April 2025

What’s Covered in this Allianz 222 Annuity Review?

In today’s review, we’ll be covering one of the Allianz annuities, the Allianz 222 Fixed Index Annuity with Protected Income Value.

The Allianz 222 is a fixed index annuity with available riders that provide lifetime income guarantees/death benefits and a few other bells and whistles.

If you’ve been pitched the Allianz 222 annuity and are looking for all the info – good, bad, ugly and even a 35-minute video that shows exactly how to determine the REAL returns you might earn with this annuity – you’re in the right place!

(Note: Because the Allianz company’s name sounds so much like the word “alliance,” it is sometimes referenced by those seeking more information as Alliance annuities – or in this particular case, Alliance 222 annuity).

Why do we specify real returns? One of the most concerning things about annuity sales today is the way these financial products are sometimes presented by financial salespeople.

Annuities provide benefits that a conservative retiree might find desirable, but they are sometimes sold with the promise of returns and potential fund performance that may not be entirely true. (But keep in mind that there are various charges on many annuity contracts that could lower the overall return, too. Some of these may require you to contribute an additional amount of premium).

Also, because the market tends to move up and down regularly, index-linked annuities such as the Allianz 222 may have a better return in some years over others.

For instance, a 30% drop like the one incurred during the Coronavirus outbreak can literally happen overnight. In this case, the market was at an all-time high in mid-February 2020, only to incur daily 3- and 4-figure losses consistently throughout the following weeks. Ouch!

And as always, it’s important to keep in mind that past performance is definitely no guarantee of the future results that you’ll receive in most any financial vehicle.

This is especially the case when it comes to your life savings.

Before you buy, it’s important you understand the savings and income components of the annuity, along with the difference between what financial salespeople say, and how the product actually works, so you can determine if the annuity is a good fit for you.

Be especially careful if the financial salesperson tries to use this annuity as a replacement for an existing annuity you already own, but that still has surrender penalties and charges.

As the long-time sweetheart of the annuity industry, the Allianz 222 offers buyers a rather large bonus which can sound attractive, but which you’ll learn shortly is far from a free lunch.

Annuity and Retirement Income Planning Education You Can Actually Trust

A popular way people are getting introduced to this annuity is through free local dinner seminars where financial salespeople send out thousands of direct mail pieces to invite folks generally ages 50 to 75 to a local restaurant for financial education and a free dinner.

Attendees are told about how each of the annuity’s components – tax-deferred growth and income – could benefit them both before and after retirement.

After the seminar presentation, the annuity sales agent encourages the seminar attendees to sign up for a free consultation where the Allianz 222 may be proposed as a possible option for their retirement financial needs.

There are also a ton of annuity marketing websites advertising either education on annuities or making bold claims that are also responsible for introducing many people to the Allianz 222.

For readers who have found this website for the first time and don’t know much about us, we are an independent annuity research firm composed of licensed annuity agents, researchers and self-proclaimed math geeks that have joined forces to revolutionize the annuity industry.

We started AnnuityGator.com to publish the most comprehensive, independent annuity reviews on the web; and have been doing so longer than any of the (now many) copycat sites out there.

If you stumble upon other “independent” “unbiased” or “impartial” annuity review websites, you’ll know what we’re talking about. 😉

We firmly believe that the financial industry has gotten too expensive, too complicated, and too out of touch with actually helping people reach their goals.

We want to change the status quo and start a high quality, low cost, results-driven retirement planning revolution.

Now that we’re acquainted, let’s dig in!

Opening Thoughts On The Allianz 222 Annuity With Protected Income Value

Allianz annuities have a long history on the market. For nearly 125 years, Allianz Life Insurance Company of North America has been helping Americans prepare for their financial future. Allianz is a leading provider of retirement solutions – including annuities – which can provide an income stream for life and scores high on the claims paying ability scale.

The company is a subsidiary of Allianz SE, a global financial services group that is based in Munich, Germany. The consistently high ratings earned by Allianz reflects the company’s financial stability and strong balance sheet. These include a(n):

- A+ (Superior) from A.M. Best

- A1 from Moody’s Investor Services

- AA (Very strong) from Standard & Poor’s

In fact, you can check out the company’s historical ratings that go all the way back to 2002 HERE.

When it comes to understanding how it stands among Allianz annuities, you might say that the Allianz 222 is like a Swiss Army Knife – it does a lot of things okay, but it doesn’t do any one thing really well.

In the past, people bought index annuities because they were pitched as a way to get market linked upside with no market downside.

Now that interest rates are super low, however, the upside may be somewhat limited.

As a result, many insurance companies have pivoted to make their products more about lifetime income guarantees. In terms of index annuities, many have done this by adding “riders” that add an income benefit to the base product.

While most insurance companies aren’t fond of the term, there are quite a few agents that use the term “hybrid annuity” when describing this updated version of the original index annuity. Be careful, though, with this term.

“Hybrid Annuity” is just a marketing term. It’s nothing special, and in reality, annuities (for the most part) have always been hybrid in nature because they do more than just one thing. (They can grow money and pay out income).

One other really interesting feature of the Allianz 222 is one of its crediting methods (which is the way you actually make money with an indexed annuity). Allianz has added the Barclays US Dynamic Balance Index as a way of demonstrating its “superior returns”.

Our review will cover this more in a few minutes – but buyer beware that some annuity sales agents depend on their hypothetical illustrations in order to sell the Allianz 222 to investors.

When the Barclays US Dynamic Index I didn’t perform as well as they wanted it to, they pulled a switcheroo and changed the index. How about them apples?

Please be aware that these returns are not based on what IS guaranteed, but rather on what MIGHT be guaranteed.

Some of the hot-selling annuity products like the Allianz 222 may do their best to paint a rosy picture WITHOUT showing you the part with the thorns.

In fact, it is possible that you recently attended a dinner seminar or an online webinar where the annuity sales agent went to great pains pointing out all of the Allianz 222 annuity’s high points, but neglected to discuss the possible drawbacks.

But if you’re planning to put a sizable chunk of your money into this annuity, the possible drawbacks are something you need to know about!

You’ll find out when we dig deeper into some super-nerdy analysis that the returns offered by this annuity really aren’t a big deal, nor is it that great of an index.

But the sales folks may talk it up pretty good – so be sure to stay tuned so you can learn how much value this new interest crediting method can really add.

In order to truly get an idea of whether or not fixed indexed annuities such as the Allianz 222 annuity is right for you,

In the case of the Allianz 222 product, its name actually implies what it does:

2 Ways to get a bonus to your Protected Income Value

- Allianz 222 offers a 15% bonus (as of August 2020) on any premium you put into your annuity in the first 18 months.

- You also receive an interest bonus equal to 50% of any interest you earn from your allocations (more on this later).

2 Ways to get an income increase from your Protected Income Value

- Once you start receiving income, your lifetime income withdrawals can increase based on any interest you’ve earned, in addition to the above-mentioned bonus

- And, you can double your annual maximum withdrawal under certain hospital / nursing care / assisted living situations.

2 Ways to get a Death Benefit

- Your beneficiaries can receive your annuities full accumulation value (very different than the fancy income values from above).

- Or, they can get the full protected income value as annuity payments spread out over 5 years.

For more info on the Allianz annuity bonuses you can go directly to the source here.

Before we get into the gritty details, here are some legal disclosures…

This is an independent product review, not a recommendation to buy or sell annuities. Allianz Life Insurance Company of North America has not endorsed this review in any way nor do we receive any compensation for this review. This Allianz 222 annuity review is meant to be an independent review at the request of readers so they could see our perspective when breaking down the positives and negatives of this particular model annuity. Before purchasing any investment product be sure to do your own due diligence and consult a properly licensed professional should you have specific questions as they relate to your individual circumstances. All names, marks, and materials used for this review are the property of their respective owners.

How Allianz Life Insurance Company of North America Describes the Allianz 222 Fixed Index Annuity

Per the 222 brochure, here are some key points as to how it’s marketed and sold:

- Principal protection / no loss of principal in any type of market environment

- Valuable guarantees and death benefit protection

- Income tax deferral / tax-deferred growth

- Several income options, including an option for guaranteed lifetime income / lifetime income withdrawals

- More than one option for market indexes to track

- Flexible interest crediting options and death benefit

There are a few more bells and whistles, but those are the basics. If you’re looking for the full brochure, you can find it here.

Because the Allianz 222 isn’t a variable annuity, there isn’t an actual prospectus to review. However, if you’re still wanting more information on this particular annuity directly from the source which includes more details on the annuity’s withdrawal charges and surrender charge period, you can go HERE to check out an overview, and even a short video that provides even more in-depth details from Allianz.

How Financial Advisors Might “Pitch” The Allianz 222 Annuity

The Allianz 222 is a lot like other annuities that brokers/agents call a hybrid annuity. In the past few years, insurance agents have fallen in love with the term “hybrid annuity.”

Even though the insurance companies don’t seem to like the term a whole lot, we guess the cool sounding name makes it easier to sell annuities, so it’s caught on nonetheless.

When sales agents use the term “hybrid,” they are referring to an annuity that has multiple annuity features rolled into a single product.

In the case of the 222 Annuity from Allianz Life Insurance Company of North America, it combines a lifetime income guarantee or other payout options with the possibility of higher returns based on market-linked credit methods; so whether Allianz likes it or not – some annuity sales agents may call it a hybrid annuity.

If you hear it described as a “hybrid annuity” – there are a few different ways it might be pitched. Our experience, however, is that most sales agents will cling to these main components:

- The protection from market losses combined with higher return potential

- The guaranteed income for life via the Protected Income Value (PIV)

- The return potential via the Barclays US Dynamic Balance Index

While those are true statements, the Allianz 222 annuity is not perfect (nor all bad). It can work okay when used correctly but has shortcomings just like any other financial product. One of the biggest issues we’ve run into is that some insurance sales agents may misrepresent how this annuity will actually perform. This may even include leaving out the details about the surrender charge period.

That’s a problem.

From the many people we’ve talked to personally about their experience working with financial salespeople, oftentimes people have been told this annuity will perform “better” than other annuities.

The sales people seem to really tout the large bonus, along with the guaranteed income potential of the Protected Income Value feature.

Is all of that true? Eh, not exactly.

If your agent/advisor/salesperson explains this annuity correctly, you may never get the impression you’ll earn more than 2% to 6%. It could produce a return of less than 1%, and if surrendered early you could actually lose money.

If you are being sold bigger hypothetical returns than that in your agent’s sales pitch – run, don’t walk, to find a more honest financial advisor.

It can also be really helpful if you know how – and how much – the advisor who is offering you this annuity is getting paid. Unfortunately, even though the majority of insurance and financial services representatives work hard to do what is best for their clients, money definitely still talks – and if a commissioned salesperson is weighing the odds between being able to eat steak or mac and cheese, they’re more than likely going to push hard to make a sale.

Some Important Info on the Barclays Dynamic Balance Index Returns

A feature that has started to come up with many of the newest fixed index annuities are proprietary indexes for determining the returns (or index credits) of the annuity. In the case of the Allianz, many of their newest products (like the 222, 365, and 365i) include the Barclays Dynamic Balance Index.

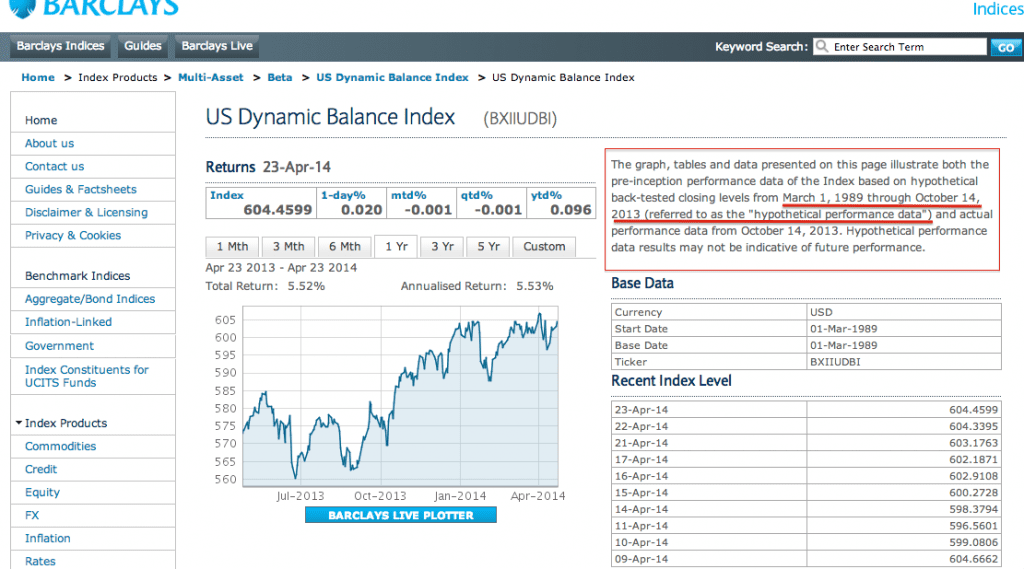

When we first wrote this Allianz 222 review, we warned investors that the Dynamic Balance I Index was new.

It shows a history going back to 1989, but that is almost all back-tested. Back-testing is done to show how the formula used to create the index WOULD HAVE measured up in past market conditions.

We all need to be extremely careful when we look at back-tested data as it is done with the benefit of hindsight. In other words, pretty much anyone can create a special “formula” that would have picked all the best investments and times to be in the market.

Just because something back-tests well does NOT mean it will perform the same in the future.

Case in point: we now have a new development to report…

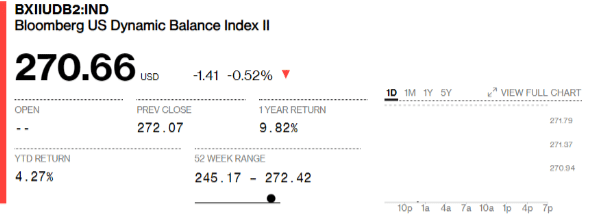

Prior to 2015, the Alliance 222 used the Barclay US Dynamic Balance I Index in order to give investors a hypothetical illustration of returns. Now, they are using the Barclays US Dynamic Balance II Index, which has only been in existence since April 14, 2015.

We actually spoke with an internal sales consultant and asked why they changed from the Barclays I to the Barclays II, and were told, “because this one back tested higher than the other.”

Take a look for yourself at the difference. Here’s the disclosure directly from the Barclays website indicating the back-tested data and its limitations (red box and lines added by AnnuityGator.com):

This is the OLD index used prior to 2015:

Here is a link to the most current Allianz 222 annuity index rates.

These rates are guaranteed for one year. They are declared at the time of issue and on each contract anniversary. To check out the most up-to-date Allianz 222 annuity rates and index crediting methods, go here.

(Note here that the returns can differ, depending on your state of residence). You can also take a look at the chart below, which also shows the movement of this index through March 2021.

Source: www.bloomberg.com/quote/BXIIUDB2:IND

Accessed: August 11, 2020

Accessed: March 31, 2021. Remember, some financial sales folks may depend on these hypothetical illustrations to make their pitch look impressive.

Here again, there are actually two versions with different caps and spreads on the crediting methods used by the Allianz 222 depending on what state you live in.

If you watch the video below, we break this down in detail using data directly from Barclays. If you didn’t watch the video, then just let this text be your caution.

If the Barclays Dynamic Balance I Index was new, then the Barclays Dynamic Balance II is in its infant stage, not even crawling yet.

We’d caution against putting any real weight on the validity of these hypothetical returns. Plus, there are other items, such as surrender charges, that could also have an impact on the overall return that you receive.

There are other potential items that can reduce the amount of net spendable income that you receive. For instance, you will incur ordinary income tax on withdrawals. For instance, in a non-qualified account, taxes would be due on the gains, but not the amount that is considered a return of your premium. But if you’ve “rolled” money over from an account funded with pre-tax dollars – such as a traditional IRA or 401(k) – then you would owe ordinary income tax on the entire amount of your withdrawals.

Plus, you could also have to pay a 10% early withdrawal charge to the IRS if you make withdrawals before you turn age 59 1/2 – even if you do so after the surrender period has elapsed).

The Annuity Gator’s End Take on the Allianz 222 Annuity with Protected Income Value (PIV):

Where it works best:

- For producing a reliable, “pension-like” guaranteed income stream / lifetime withdrawals (although there are other annuities with higher guaranteed income at this time)

- For producing lifetime income payments / an income for life that cannot be outlived by a surviving spouse

- For investors who have a family history of longevity

- For investors that have no need for their money or generating large returns, but want it to grow safely until transferred to their beneficiaries

- For investors willing to defer income payments from the annuity for 10 years or longer in order to get maximum benefit from the PIV (protected income value)

Where it works worst:

- For those that do not plan on using the Protected Income Value (PIV) feature

- For those seeking maximum long-term growth

- For those looking for a good “worst case scenario” annuity

- For those who don’t want to incur surrender charges if they need to make withdrawals in the early years

We should also note that we only tested a few of the many ways this annuity can be structured. It has other indexes the interest can be calculated against, different options on the income rider, and most importantly – the returns will vary based on each unique persons’ circumstances.

In general, though, this is a fairly comprehensive review that will hopefully help many people better understand how the Allianz 222 Annuity really works.

And, like with most any other product or service out there in the market, there has been a fair share of Allianz 222 annuity complaints. You can take a peek at how this annuity has performed for other investors by reading the Allianz 222 annuity testimonials here.

Despite Allianz being a reputable company, based on our review of the Allianz 222 complaints, it appears that some of the folks that bought this product may not have been properly educated about its features.

Given the fact that the Allianz 222 – or any annuity, for that matter – can be somewhat confusing (especially indexed products) – it is all the more important to review the Allianz 222 statement of understanding before you move forward and commit to this product.

As you can see in the statement of understanding example that is linked here, there is a lot more detailed information – which may or may not always mirror exactly what your financial advisor has touted.

In Summary

One of the most important things for investors to understand is that the “Protected Income Value” is not the actual return, nor is the “income percentage” the actual return. We’re having a difficult time seeing it produce the 5% to 8% return numbers a lot of uneducated financial salespersons toss around when trying to get you to buy it.

As noted in the video review below, a couple both age 60 with a 30-year life expectancy could realistically expect to earn somewhere between 2% and 6% over the next 30 years – depending on which options they select and how long they defer taking income.

You should know that you can improve your income situation by as much as 10% annually if you work with a financial professional who knows how to employ a strategy with these income creation tools.

These annuity optimization strategies may lock in a greater guaranteed income for life.

Most financial salespeople who are only interested in selling products (and fee-based advisors who can’t sell annuities) typically don’t know how to employ these creative and mathematically optimized strategies, and so investors are left on their own to figure it out.

For someone strictly looking for guaranteed income with no market risk, the Allianz 222 can do the job, there may be better options available.

For someone looking for an investment that cannot go down, is content with low / mid-to-single digit returns, and wants the transfer of risk annuities are really good at – this might be a good fit, though we’ve reviewed other annuities we think do that better.

Also, we’re still convinced some agents don’t realize what the real returns are, and may significantly over-promise what’s realistic – so be especially wary of anyone who suggests this annuity will work better than how we illustrated it here.

If the agents are being upfront and honest, you’ll notice their explanations will match very closely (if not exactly) as described in this review. When that happens, you have an agent you can trust.

Allianz has done a very good job of producing easy to understand literature that in no way misrepresents their product. They can’t, however, control every word that comes out of every insurance sales agent’s mouth – so just always be careful out there!

As a recap to the video below (for those that don’t have 35+ minutes to watch it), the Allianz 222 Annuity may not actually give a 7% return. Nor will it likely return 6%, and it’s possible the real returns will be 5% or less (maybe even 2% or less).

When financial advisors use the bigger numbers, they are referring to percentages used to calculate the income guarantee.

In summary, the Allianz 222 has good attributes – it’s backed by a quality company, it has the potential for growth, and you do have some access to money. BUT it may fall short on guaranteed income.

People often buy lifetime guaranteed income annuities for what they WILL provide, not for what they MIGHT provide. Allianz is big on the might, and it might not be as mighty as other annuities out there.

If you want to see if there are other annuities that can go up against the mighty Allianz 222, you can reach us via the Free Annuity Help form below.

We can show you what your other options are so that you can compare and point you in the right direction.

Bottom Line of This Review: While we certainly understand that the Allianz 222 annuity has both pros and cons, we’ve found that there may still actually be some better alternatives out there.

Really, though, the only way to know if this annuity is a good fit for you is to have it tested. We do this free at AnnuityGator.com, so just get in touch with us using the form below and we’ll run our proprietary annuity review software based on your scenario.

This process allows you to compare one annuity against the other so you can see for yourself what gives your dollar the best benefits and highest income guarantees.

If your agent was honest with you, then you won’t be surprised by the numbers, and if they don’t match up, well then you might want to reconsider who you are working with.

We’ve worked with many wealthy people who were afraid to spend a dime during retirement because all their money was in the market. They were afraid to spend it because they knew that in today’s global economy, anything can happen. The money could be gone tomorrow based on the latest news cycle.

The Allianz 222 can get you a guaranteed income, but dollar for dollar, there may be other annuities we have seen that can provide you with more income.

When you choose what we call “high-performance annuities” and combine them with a mathematically optimized plan, you can get the maximum effect and benefit out of every dollar saved.

Have Questions on the Allianz 222 or other Allianz Annuities? Did You See Any Mistakes in this Allianz 222 Annuity Review?

Annuities can be complex. That’s where having an Annuity Investigator who loves math comes in. We make the complex, simple.

Annuities can be complex. That’s where having an Annuity Investigator who loves math comes in. We make the complex, simple

If you have questions please let us know. [You can reach me via the Free Annuity Help form here]

We realize that annuities can be complex and confusing and a lot of financial salespeople are pushing investors hard to buy them.

But you need to know the real facts to make sure if you go that route, you don’t end up regretting it later.

After all, annuities are long-term investment vehicles with contracts, surrender penalties, etc. For some people, they won’t make sense at all, but for some, they might.

That’s where having an Annuity Investigator who loves math comes in. We make the complex simple.

If you know anyone who has an annuity or is thinking of buying one, please share this post with them. We know a lot of people are getting very conflicting information and our goal in writing this review and making the video was to educate in an objective way.

If you have a Facebook account you can click on the little “Facebook” icon and share this article. That way more people will be able to find it and hopefully, more people will benefit.

Thanks for bearing with us on this rather long post. We hope you found it beneficial in your research. Lastly, like all humans – we do make mistakes. If you see one on this review please reach out and let us know.

We are always more than happy to make corrections and give credit where it is due. If you’re an investor and this review causes confusion and creates questions, feel free to reach out as well.

We can’t always get back right away but usually, we can clear up those questions within a day or two.

Best,

The Annuity Gator

P.S. We included a few more related links to the Allianz 222 below that you might find useful:

- Allianz 222 Annuity Complaints

- Allianz 222 Annuity Statement of Understanding

- Barclays U.S. Dynamic Balance Index ll

P.P.S If you would like to read more reviews of Allianz annuities here are some links to check out:

77 Comments

Please review the American Equity Bonus Gold Fixed Indexed Annuity.

Hi and thank you for your comment. We are always updating our annuity review database, so we appreciate the suggestion of the American Equity Bonus Gold, as well as the Athene Anexus fixed indexed annuity in your other comment. We will add these annuities to our list of upcoming reviews. Please check back for these, as well as any other reviews. And, if we can help to answer any questions, feel free to reach out to us directly at (888) 440-2468, or set up a time to chat with one of our annuity specialists by visiting: http://www.annuitygator.com/contact/. We look forward to hearing from you. Best! Annuity Gator

I purchased the Allianz 222 in June of 2016 for $220,000. I have it split 50/50 in the Dynamic Balance II with Cap and Spread. My ACTUAL return in year 1 was 4.39%. In year 2 it was 4.38%. If, and if is a big word, the interest rate stays about the same, I will have grown the original $220,000 to approx. $338,000 with ZERO market risk. I find that hard to beat with the way the market goes up and down! Just Say’n!

Hi Mark – Thanks so much for your comment. It’s always great to hear that a financial vehicle is performing well – at, or better, than anticipated. Please let us know if we can help with any questions you have going forward. We can be reached directly, toll-free, at (888) 440-2468, or via email at: http://www.annuitygator.com/contact/. Best! Annuity Gator Team

I have a question about the death benefit of the Allianz 222. It states that your beneficiaries can receive the full protected income value as annuity payments over at least five years. However it also states that “to receive the protected income value, including any premium bonuses and interest bonuses, you must hold your annuity in deferral for at least 10 contract years and begin receiving lifetime withdrawals.” What happens if the policy holder dies in year 5? Can the beneficiaries still receive the PIV with bonuses included or do they lose the bonuses since the policy wasn’t held for 10 years or can they only receive the account value in that case? Thanks.

Hi Dave – Thank you for your question. If death occurs, the beneficiary would be able to choose the greater of: 1) the accumulation value, 2) the guaranteed minimum value, or 3) the cumulative withdrawal amount. Its important to note that the PIV is not actually part of the death benefit, but rather a way of calculating the income payments, so it would not factor into the death benefit. Please let us know if you have any additional questions. We can be reached directly at (888) 440-2368, or through our secure online contact form at https://www.annuitygator.com/contact/. Best! Annuity Gator

My financial adviser pitched ne the Allianz 222 with a 30% bonus. I was sent hypotheticals example. It all looked to good to be true. Would you have time to analyze this if I emailed to you? Please let me know. Thank you.

Hi Tim – Thank you for your comment. We would absolutely be happy to take a look at the illustration. Please feel free to contact us directly via phone at (888) 440-2460. Or alternatively, you can contact us online at https://www.annuitygator.com/contact/ to set up a time to chat with one of our annuity “geeks.” Thanks, we look forward to talking with you. Best! Annuity Gator

Why have I not received quarterly statements?

Hi Belinda – Thank you for your message. It could be that you are receiving the statements online. We would be happy to help, but need some additional information regarding your annuity and the insurance carrier that you purchased it through. Please feel free to reach out to us directly, toll-free, at 888-440-2468, or to set up a time to meet through our secure online contact form at https://www.annuitygator.com/contact/. We look forward to talking with you. Best! Annuity Gator

Hi! Trying to replicate your spreadsheet. Can’t get your PIV at year 10, 11 and forward. Was supposed to have a call today from Annuity Gator at 4 pm today but my person was a no show. Is there any way to receive a copy of your excel sheet so I can see the calculations?

Hi Joanne – Thank you for your message – and we apologize for the mix-up on the call. We would be happy to get a copy of the spreadsheet to you. Rather than put your personal email address on this Q&A area, though, please call us at your convenience at (888) 440-2468. We look forward to hearing from you. Best! The Annuity Gator

Hi, I found finding reviews on this product difficult so appreciated your video. I have $400k to invest from a 401k. My agent is suggesting putting 2/3 in this annuity and then investing the rest in the market. I’m under 50 and will be taking a few year hiatus from working. Any advice?

Hi Barb – Thank you for your message. We would be happy to help. There is some additional information that we would need from you first, though, in order to determine what may (or may not) be right in your specific situation. Rather than passing sensitive details back and forth via email, it would be best to chat by phone. Please feel free to reach out to us directly, toll-free, at (888) 440-2468. You can also reach us by email to set up a time by going to http://www.annuitygator.com/contact/. We look forward to hearing from you. Best! The Annuity Gator

Allianz Annuities are awful. They take your money, pay their agents fat checks directly from your deposit, and then no matter what you do, will not release your funds. They are crooks plain and simple. Do not put any money into these accounts.

Hi Shari – Thank you for your comment. Depending on how long you have had the annuity, there may be a way to roll it into an alternative that works better for your specific needs. Please feel free to contact us if you would like to narrow down some options. We can be reached directly at (888) 440-2468 or online by going to: https://www.annuitygator.com/contact/ . Best! The Annuity Gator

I just purchased the 222 last year and after reading your website I wonder if there is something better is it to late to pull out without major fees and penalties to convert to one of your recommendations?

Hi Greg – Thank you for your comment. While it is probable that the 222 annuity is still within its surrender period, there could still be some alternate options. For example, rolling the funds from the 222 into another annuity option that better fits your needs may be possible. We would be happy to review the details with you and let you know how the annuity rollover process works. You can contact us directly at (888) 440-2468 or by simply going to: https://www.annuitygator.com/contact/ . Best! The Annuity Gator

Well done. Thanks

Hi Kris – Thanks so much for checking in and visiting the AnnuityGator.com website. Always happy to hear that the reviews and information are helpful. Please visit again soon. Best. – Annuity Gator Team

Hi Kris – Thank you for your message. As information about most annuities can – and often does – change, we are always adding and updating the details here on the AnnuityGator.com website. Please check back in again soon. Best. – Annuity Gator Team

I’m interested in annuities that improve on Allianz 222 returns.

Hi Althea – Thank you for your comment. We would be happy to help you out. Because everyone’s situation is different – as well as the goals that you may have for your annuity – we would first need to get a bit more information from you before we could make a good recommendation. Rather than emailing confidential details back and forth, though, please contact us directly at (888) 440-2468 so that we can obtain the details that can help to focus on the annuity options that are best for you. Best. -Annuity Gator Team

Hi Althea – Thank you for your message. We would be happy to chat with you regarding annuities that may improve on the Allianz 222 returns. In order to provide you with the best information, though, we would need to get a bit more information from you. Rather than emailing sensitive personal details back and forth, though, please contact us via phone, toll-free, at (888) 440-2468. We look forward to speaking with you. Best. – Annuity Gator Team

Jason,

You have made a serious error in your video. You have not included the increasing income in your 222 analysis. Increasing income means that in year 11, if your first year’s income was $10,000, and during that same year you get a 4% return, they will apply the 50% annual interest bonus, which makes a 6% increase in year 12 to $10,600, and so on every year. If you had run an illustration from Allianz or even read the Statement of Understanding you would know this. As it is, your video is misrepresenting one of the most powerful elements of the 222. You are doing to your readers the very thing you accuse other agents of doing: misrepresenting the product, either through ignorance or deceit.

I would ask that you contact me to let me know you got this email.

Elizabeth Blane

Hi Elizabeth – Thank you for your comment, and for notifying us of the error. We have now updated the review of the Allianz 222 annuity on our AnnuityGator.com site, which will include an updated video as well. Please check back soon in order to check out the new review and video. And, if we can assist you with any other questions or concerns, please feel free to reach out to us directly via phone at (888) 440-2468. Best. – Annuity Gator Team

What is the commission the sales agent earns on this product?

Hi Kurt – Thank you for your comment. With the Allianz 222 annuity, there are actually different commission levels, based on the age of the annuity purchaser at the time of purchase, as well as which of the Allianz 222 product options you go with. For example, with Option A, if the applicant is age 0 to 75, the first year commission is 6.65%, and the commission in years 2 and 3 is 3.325%. For ages 76 to 80, the Year 1 commission is 4.75%, and Years 2-3 is 2.375%. With Option B, for ages 0 to 75, Year 1 = 4.75 and Years 2-3 = 2.375. With this option, ages 76-80 has a Year 1 commission of 3.325% and Years 2-3 of 1.663%. There is also a trailing commission in years 2+ of 0.475%. There is also an Option C. With this option, for ages 0 – 75, Year 1 commission is 2.138%, and Years 2-3 is 1.069, with a trailing commission of 0.95%. For those who are between the ages of 76-80, the Year 1 commission is 1.9%, and Years 2-3 is 0.95%, with a trailing commission after that of 0.713%. It is important to note, though, that this information can change. So, just to be safe, if you are considering this – or any other – annuity, for the most updated details, you can give us a call directly at (888) 440-2468. Best! Annuity Gator Team

Jason, you mention the income increase early in the discussion but never include it after.

The fact that the lifetime income can, and probably will, increase seems like a nice benefit and sets it apart from most other income plans. Over a 10-20 year period, that could be significant.

Hi Jim – Thank you for your comment, and for notifying us of the missing information. We have now updated the review of the Allianz 222 annuity on our AnnuityGator.com site, which will include an updated video as well. Please check back soon in order to check out the new review and video. And, if we can assist you with any other questions or concerns, please feel free to reach out to us directly via phone at (888) 440-2468. Best. – Annuity Gator Team

Jason, can you run a scenario with $700,000.00 Also the bonus now I am told is 15% is that the case for September 2016 timeframe. Also run the scenario with guaranteed results.

Thanks

James

Hi James – Thank you for your email. We can help you with running a scenario, but would need some additional information in order to do so. Rather than email that info back and forth, you can contact us directly via phone so that your information can remain more protected. We can be reached at (888) 440-2468. Best. Annuity Gator Team

HI there,

I just saw your video and would would like information and would like to have you run a scenario, with a 100,000 dollars. Also, include a 20% bonus.

Jim

Hi Jason,

You offered “If you want to see if there are other annuities that can go up against the mighty Allianz 222” to contact you – so here I am. What others can you tell me about? What makes them a grade A vs the grade B you gave the 222?

And what is “the withdraw and lever-up” strategy? Googling that term hasn’t provided much info for those of us that prefer less jargon and clear explanations.

Thanx, JB

HI JB – Thank you for your message. We would be happy to go over some of the other annuities that can go up against the Allianz 222. In order to give you the best advice that is based on your specific situation, we would need to get a bit more information from you. Rather than emailing sensitive personal details back and forth, though, it would likely be best to chat via phone. Please contact us directly at (888) 440-2468. We look forward to talking with you. Best. – Annuity Gator Team

Hi

my husband and I we went to fin. seminar and they offered us Allianz 222 annuity with 20% bonus,and appear. 4-6% return on our money.

Since we both are 72 years old and afraid to loose money in stock market do you think this product might be good for us?

Thank you

Nadia

Hi Nadia – Thank you for your comment. This annuity could be a good fit for you – however, this suitability can also depend on many other factors that are in addition to the annuity itself. We can help you to determine whether or not to go ahead with the Allianz 222. However, rather than emailing specific personal information back and forth, please feel free to contact us via phone at (888) 440-2468 and we can walk you through various scenarios that can help you to make this decision. Best. Annuity Gator Team

Hi Nadia – Thank you for your message. The Allianz 222 could be a good option for you, depending on your situation, retirement time frame, and several other factors. We would be happy to discuss this annuity, as well as some other potential options with you. In order to provide you with the best advice, though, we would need to get a bit more information from you. Rather than emailing sensitive details back and forth, though, it would be best to chat via phone. Please feel free to reach out to us directly, toll-free, at (888) 440-2468. We look forward to speaking with you. Best. -AnnuityGator Team

Thank you for the explanation of the 222 annuity. I will listen to it again as I really want to understand the product as I am being “encouraged” to roll my tsp into this product. I am 68 year old and have a significant tsp balance. In addition to the returns have concerns with the penalties associated with withdrawing from the annuity. Are my concerns legitimate.

Hi Myrtle – Thank you for your message. Your concerns are very legitimate, as you want to be sure that you are putting your money into a vehicle that will provide you with what you need in terms of income and safety, as well as any penalties that could be assessed if you decide to withdraw your funds before the surrender period has ended. If you would like to discuss more in-depth how the Allianz 222 annuity works, please don’t hesitate to contact us directly via phone, toll-free, at (888) 440-2468. Best. – Annuity Gator Team

Hi Myrtle – Thank you for your message. We have actually just recently updated our Allianz 222 annuity review, so please feel free to check back to our AnnuityGator.com website in order to check out the May 2017 information. And, if you have any additional questions, please contact us directly via phone, toll-free, at (888) 440-2468. Best. -AnnuityGator Team

I can’t access the video. Please advise.

Hi Virginia – Thank you for your message. There were actually some updates that were made to that particular annuity review. You can now access the updated information, as well as the video, by clicking here: https://www.annuitygator.com/annuity-review/independent-objective-review-of-the-allianz-222-annuity/

Please let us know if we can help further.

Best.

– Annuity Gator Team

Allianz 222 video link missing or not working.

Hi Matt – Thank you for your message. There actually were some updates made to the Allianz 222 annuity review. But the video is now up again and running. You can find the updated review and video here: https://www.annuitygator.com/independent-objective-review-of-the-allianz-222-annuity So, please feel free to check back in again soon.

Best.

– Annuity Gator Team

had a question,

now that its Feb. 2016 i feel the growth % you used in the video is WAY OUT OF LINE.Agree????? could you run the same chart for me with an updated %,say maybe only 2%.im 57 my wife is 60.use the 100k and what would the chart look like with a joint with equal payments to my spouse after i pass.joint and survivor i guess you call it

Hi Greg. Thank you for your message. We would be happy to run an illustration for you, based on your specific criteria. We would actually need a bit more information from you, though. Rather than emailing personal details back and forth, please contact us via phone at your convenience at (888) 440-2468. We look forward to talking with you. Best. – Annuity Gator Team

While I am not a huge fan of the Allianz 222, the point is that as with any annuity, even if an index has not been around, you can still replicate the returns with appropriate data. This can and is used for “potential” returns, not guaranteed returns. An illustration should be provided at the time of sale.

What is important to understand about Equity Linked Index Annuities is that principal and accredited gains are locked in (except in cases of surrender) each period (determined by the particular annuity that you have).

So the worst case scenario IS important and that is unless you surrender or take more than allotted surrender-free withdrawals, you are not going to lose not only your principal, but your accumulated value as long as the insurance company is solvent (which is why to use high rated insurance carriers).

And this is the moral of the story.

Thank you for helping clarify things. I sell annuities and admit, they are complex.

Hi Vanessa – Thank you for your comment. As annuities are quite complex, we prefer to err on the side of providing “too much” information, rather than not enough. We appreciate you visiting the site. Please let us know if we can help further and / or if there are any particular annuities that you would like to see us review. Best. – Annuity Gator Team

DOES THIS ARTICLES’ REFERENCE TO THE RETURNS REFLECT THE CURRENT ALLIANZ CAPS?

Hi Lisa – Thank you for your comment. We have now updated the review of the Allianz 222 annuity on our AnnuityGator.com site, which will also include an updated video as well. Please check back soon in order to check out the new review and video. And, if we can assist you with any other questions or concerns, please feel free to reach out to us directly via phone at (888) 440-2468. Best. – Annuity Gator Team

If I transfer my $100,000 traditional IRA to this annuity then (heaven forbid!)die a month after, will my beneficiary get the $100,000 PLUS the 15% bonus — $115,000??? Or does that bonus have to be earned over a period of time?

Hi Edwina – Thank you for your message. In answer to your question about the bonus, yes, although your contract value would reflect the amount of the bonus, this is something that would need to be earned over a period of time. Please let us know if we can answer any additional questions for you regarding the Allianz 222, or any other annuity that you may want additional information on. Best. – Annuity Gator Team

Wow, I’m more confused than ever! Sorry to say. My advisor is pushing this exact product, 600K into one where it would sit for 2 years and I would then “raid” it for 10 years at 60K a year then turn on the income stream at what he says would be near 30K a year. Joint income, 11 years between us. But then he also selling me on putting another 200K in another 222 that wouldn’t be touched for the 10 years period and would pay out some 24ish per year to supplement the change in the original when I turn on the income stream. Really, I am sort of torn up trying to reach a decision. I’m near 64, retiring at 66, my wife is 52 and doesn’t work. with almost a million saved up and pretty much risk adverse this sounds OK to me BUT is it? Could I be making a decision that will haunt me to death or is the peace of mind I think I could get actually worth the crappy returns if any.

Hi Rich – Thank you for your message. We would be happy to walk you through various scenarios using the Allianz 222 (or possibly another alternative, depending on your specific goals. In order to offer you the best information, we would need some additional details from you – which would likely be better discussed via phone as versus sending it back and forth through email. Please contact our team directly at (888) 440-2468. We look forward to chatting with you. Best. – Annuity Gator Team

Hi Rich – Thank you for your message. We would be happy to discuss some potential options with you. In order to provide you with the best advice, we would need to get a bit more information from you. Rather than emailing sensitive details back and forth, though, it would be best to chat via phone. Please feel free to reach out to us directly, toll-free, at (888) 440-2468. We look forward to speaking with you. Best. -AnnuityGator Team

I’m trying to watch the video and while the cursor moves around on the screen, the screen shot never changes, or only changes once about half way thru the presentation. Am I doing something wrong or watching it incorrectly. Basically, I just clicked on the play arrow inbedded in the website page and it started to play but with the results described above. Is this a problem with the website or with my PC?

Hi Mark – Thank you for your message. There were actually some updates that were made to the Allianz 222 annuity. You should be able to access it ok now (including the video) by going here: https://www.annuitygator.com/independent-objective-review-of-the-allianz-222-annuity

Please let us know if we can help further.

Best.

– Annuity Gator Team

With the Barkleys index for this product, the Allianz salesman is saying all the up increases are applyied to the Asset, if the market goes down, there is no change, but when the market goes up again, the full % up is applied to the Asset value (even though the market has not recovered to the original base line.

Can you model that to get a % return on the market in the last 20 years?

Hi Michael – Thank you for your message. We have actually just recently added an updated review of the Allianz 222 annuity to our site (with additional, more in-depth information regarding the Barclays Index as well). Please feel free to check out our AnnuityGator.com website to read this newly created review. Best. – Annuity Gator Team

Your Video offers an independent analysis. How do I request that and how long does it take ?

Hi Dan – Thank you for your message. There was actually some updates made to the Allianz 222 review. You should now be able to access the review, including the working video, by going here: https://www.annuitygator.com/independent-objective-review-of-the-allianz-222-annuity

Thanks.

Please let us know if we can help further.

Best.

– Annuity Gator Team

Hi Dan – Thank you for your message. We can actually discuss various options with you via phone, as we would need to get some additional information from you before being able to recommend any type of annuity (if any). At your convenience, please feel free to contact us toll-free at (888) 440-2468. We look forward to speaking with you. Best. – Annuity Gator Team

Your comments that this isn’t good in the worst case scenario has NEVER OCCURED

IN ANY 1000 YEAR PERIOD. I am not the fondest with Allianz but your reasoning

is out to lunch

Hi Clem,

Thanks for adding to the discussion. The issue is the index method tested has only been around for about 1 year, not 1,000 years. :). Just looking at a basic 50/50 stock bond portfolio there are many 10 year time periods the average return has been close to 0. Assuming a spread on the positive years, you have to go out 20 years for all time periods since 1920 to be break even or positive. So, if we are planning for a worst case scenario – little / no market growth is a possibility. The 50th percentile of all rolling 20 year time periods less a spread would roughly 5%. The only problem with that is if we assume we’ll get the “average” or “mean” then the there would be no point in using an annuity. The returns of just index funds would beat the annuity every time. One of the main reasons we see people using annuities is to protect from a worst case scenario. Thus, we should always look at the worst case, the average, and the best case. This annuity looks pretty good when looking at average or best case scenarios, but very bad under the worst case scenario.

– AnnuityGator

Jason

Love what you are doing, especially how you review the pros and cons of an annuity structure. Reviewing an immediate annuity would be helpful, like the vanguard income annuity. They have pretty good quotes, with so many people looking for guarantees, and an income plan, this would help!

Hi John – Thank you for your comment. We have been in the process of expanding our annuity reviews on our site – including adding some immediate annuities, so please check back soon. Best. – Annuity Gator Team

Hi John – Thank you for your message. We are always looking for additional annuity reviews to add to our site – especially if they are products that our readers are interested in. Please feel free to check back again soon when we have added this (and other) reviews to the site. Best. – Annuity Gator Team

Jason: Thank you for continuing to provide this valuable annuity review resource! Unfortunately, the video wasn’t working and it was quite difficult to follow the discussion when you were referring to columns and rows that we not on the clip. Notwithstanding that, I compared the monthly annuity payment from this hypothetical example for the Allianze 222 annuity ($13,860) with that produced by the Security Benefit Secure Income Annuity ($11,685) under the same assumptions (initial investment, age, joint annuity and 10 year deferral until age 70). The Allianze offering appears better than the Security Benefit offering, although the Security benefit is based on a guaranteed income account growth of 7% while I guess the Allianze annuity could return substantially less. Am I understanding this correctly?

Hi Keith – Thank you for your message. We have recently updated the Allianz 222 annuity review on our website, so it may better answer some of your questions. We’d also be happy to chat with you in order to determine whether or not this particular annuity would be a viable option, based on your personal circumstances. Please feel free to contact us directly, toll-free, at (888) 440-2468. Best. – Annuity Gator Team

You mentioned that there were better annuities for both growth and income. What do you consider a better alternative for growth and which annuity would be best for income?

Hi Michael – Thank you for your comment. We would be happy to provide you with some suggestions in terms of a good alternative for growth. In order to do so, though, we would need to get some additional information from you. Rather than sending sensitive personal details back and forth via email, please feel free to contact us by phone at your convenience. We can be reached at (888) 440-2468. Thanks, we look forward to chatting with you. Best. – Annuity Gator Team

Hi Michael – Thank you for your message. We would be happy to discuss some potential options with you. In order to provide you with the best advice, we would need to get a bit more information from you. Rather than emailing sensitive details back and forth, though, it would be best to chat via phone. Please feel free to reach out to us directly, toll-free, at (888) 440-2468. We look forward to speaking with you. Best. -AnnuityGator Team

Jason

I appreciate the in depth math. I understand the implied value of being a fee only advisor; in the end commission of fee neither ensures integrity or transparency.

What has me hung up is the negative emphasis on back testing because it is analysis in hindsight. Any and all discussions that involve the markets by nature have to be hindsight. Future performance discussions are a mix of prophecy and analytical guessing. The exact same situation is true of the vast majority of stock brokers referring the historical returns of the market coupled with one of the most deceptive of all pitches – the average return of the market.

Average return is ultimately meaningless, who wants a 50% return this year if I had a 40% loss last year? I just scored a 10% average return and lost a bunch of money. Clients need help understanding this concept.

The critical consideration, it seems to me, is Compound Annual Growth Rate. Effectively, what did my investment yield over the time I had it deployed? Can you speak to this point.

I enjoy the analysis, understand the broad brush strokes of agents being more booster than educator.

Tod

Hi Tod,

Thanks for the great comment!

I agree, the important things to me are:

1) If everything works out as planned, what is the real annualized return?

2) If the markets go bad, what is my worst case scenario return?

I just updated the video to make sure the calculations were easier for viewers to see. If you give it a re-watch you’ll see I show that data as it relates to the Allianz 222. Just let me know if you have any questions.

– Annuity Gator Team

Thanks for the article. Full disclosure here, I am an pension actuary and so have a strong background in annuities. My parents have been in dialog with a financial planner on investing in this product and asked that I review it. The more I read the more I like this product (assuming investment objectives are clearly thought out and compatible).

With regard to the Barclays Dynamic Balance Index (the “BDBI”), I have been looking for something like this for 10 years now. My biggest frustration with traditional mutual funds is that managers cannot deviate significantly from their investment objectives as stated in the prospectus. As a result I find myself shifting from equity mutual fund to fixed income mutual funds as I see market conditions fluctuate. The BDBI is the closest thing to a fire and forget solution that I have been looking for.

I have no issue with the back testing. The BDBI clearly state their objectives and methods. The back testing at least provides evidence that the strategy would have worked in the past. Given a choice of a s/m/l cap, indexed fund or the BDBI, I feel very comfortable with the BDBI.

Hi David – Thank you for your message. We are actually in the process of updating our review of the Allianz 222, which will include more in-depth information on the BDBI. Please feel free to check back soon for this updated information, and / or to contact us directly via phone with any additional questions that you may have. We can be reached toll-free at (888) 440-2468. Best. – Annuity Gator Team