What will we be going over in this annuity review?

In this annuity review, we will be going over the following details regarding the Lincoln National Life ChoicePlus Assurance fee-based variable annuity:

- Product Type

- Fees

- Current rates

- Realistic long-term return expectations

- How this annuity is best used

- How it is most poorly used

Annuities can be complex. That’s where having an Annuity Investigator who loves math comes in.

We make the complex, simple.

If you have been considering the purchase of an annuity because you are seeking tax-deferred growth of your money, along with a steady income during your retirement years, then the ChoicePlus Assurance fee-based variable annuity from Lincoln National could be a viable option for you.

However, you run out and sign on the dotted line to purchase this annuity – or any other annuity, for that matter – it is important that you have a thorough understanding of how it works, and how it may or may not work for you.

Annuities tend to have a plethora of moving parts, so they can be a tad bit confusing. This goes even for well-educated consumers and financial advisors. Depending on which type of annuity you are leaning towards, annuities will often have a maze of “fine print” to wade through – which is particularly the case with variable annuity products.

Unfortunately, many investors forgo working through all of the details and instead rely on their current insurance or financial advisor to lead them to the proper financial vehicle. However, this may not necessarily work to your advantage. In fact, unless your advisor has a key focus on offering annuities, he or she may not be able to provide you with all of the insight that you may need – and in turn, many investors end up finding out too late that the annuity they chose is not going to perform the way they expected it to.

If you have been thinking about moving forward with the Lincoln National Life ChoicePlus Assurance Fee Based variable annuity, then you may have noticed that, just like any other annuity, it can perform well in certain areas. But, there are other areas where it may not perform up to par – especially depending on your specific financial situation and goals.

We can help you to sort out what you need to know about this annuity from Lincoln National, and in turn, allow you to reach a better conclusion as to whether or not the ChoicePlus Assurance fee-based annuity is the right annuity product for you.

Annuity and Retirement Income Planning Information You Can Trust

If this is your very first visit to our website, then please allow us to welcome you to Annuity Gator. We are a team of financial experts who are focused on providing very comprehensive and unbiased annuity reviews. We have been at this for quite a while not – far longer than our “copycat” competitors – and we have therefore become known as a highly trusted source of annuity information.

If you have spent any amount of time at all on the Internet looking for information about annuities, then you have likely run across a number of conflicting opinions about these products. This, however, is not all that surprising, as there are many, many products available in the marketplace, and various different thoughts about them.

You may also have recently attended an annuity seminar, where the presenter provided you with details about the Lincoln National Life ChoicePlus Assurance fee-based variable annuity, or some other similar product. If so, you may even have scheduled a time to meet in person with the presenter from the seminar in order to determine whether or not this annuity is right for you. In fact, your quest to obtain more information may even have been the catalyst that has brought you here to our website.

While researching annuities online, you may also have noticed that there are other annuity websites out there that are touting how great and wonderful their products are by making some bold claims like:

- Lowest Fees

- Highest income payouts

- Guaranteed lifetime income

- Top-rated companies

Does this look at all familiar?

But, as enticing as these claims might sound, it makes it even more important for you to verify that they are actually true before you commit to placing a large chunk of your retirement savings into such a product.

That’s where we come in.

If you’ve come here to Annuity Gator in search of more in-depth information about the Lincoln National Life ChoicePlus Assurance Fee Based annuity, then you are definitely in the right place. In fact, we dare say that this website is the only place where you will be able to find all of the key facts – which include the good and the not-so-good. This, however, is the only way to make a truly well-informed decision about this (or any other) financial vehicle.

In order to be completely clear here, we want to convey that we feel annuities are able to provide investors with some very good benefits. But, this is really only the case if the product fits in with your particular financial goals.

The review that you are in the process of reading right now was created with the intent of assisting you with better understanding all of the “fine print” that is associated with the Lincoln National Life ChoicePlus Assurance Fee Based variable annuity.

So, if you are ready to get started, let’s go!

Lincoln National Life ChoicePlus Assurance Fee Based Variable Annuity at a Glance

| Product Name | Structured Capital Strategies Plus |

|---|---|

| Issuer | AXA |

| Type of Product | Variable / Buffer Annuity |

| S&P Rating | AA- (Stable) |

| Phone Number | (877) 899-3743 |

| Website | https://www.axa.com |

Opening Thoughts Regarding the Lincoln National Life ChoicePlus Assurance Fee Based Annuity

The Lincoln Financial Group has been in the business of helping its clients build and protect wealth since 1905. Throughout the past 110 years, Lincoln Life has become a highly respected financial and insurance coverage provider. The company actually consists of several entities, including the following:

- Lincoln National Life Insurance Company (Fort Wayne, Indiana)

- Lincoln Life and Annuity Company of New York

- Lincoln Financial Distributors

- Lincoln Financial Advisors

- Lincoln Financial Securities Corporation

- Lincoln Financial Foundation

The company has been ranked highly among its peers, and it is also considered to be strong and stable from a financial standpoint. Because of that, as well as the company’s timeliness in paying out its policyholders’ claims, it has been provided with high ratings from the insurer rating agencies, includes an:

- AA- from S&P

- A1 from Moody’s

- A+ from Fitch

- A+ from A.M. Best Company

If you’ve been studying up on variable annuities from Lincoln Life (or from any insurance provider), then you may already know that variable annuities are really only supposed to do two things. These are to grow principal, and to produce income. However, in reality, this type of annuity is not actually very good at producing income, primarily because of the risk that these vehicles present to the investor, as well as to the insurance company that offers them.

Because a variable annuity’s value can fluctuate so much, an insurance company that offers it can really only guarantee a lesser amount of income than the “safer” annuity alternatives like fixed annuities. In all likelihood, then, for each dollar you place into a variable annuity, it is only going to promise you less income than that of a fixed annuity would do…for the exact same money! Given that, if your primary goal for purchasing an annuity is to produce an income stream in retirement, then a variable annuity may not be the best option for you.

On the investment side, a variable annuity can provide investors the opportunity of unlimited growth. But along with that also comes downside market risk. There are also typically a number of fees assessed with variable annuities.

First, within a variable annuity, the sub-accounts are usually invested in mutual funds. These will generally have their own fees within the funds themselves. In addition, a variable annuity itself, in most cases, will oftentimes require a front-end sales / commission charge – so an investor will immediately start off with a “loss.” This, in turn, can make it pretty difficult for the account to grow when it is already starting from behind.

The Lincoln National Life ChoicePlus Assurance Fee Based variable annuity works a bit differently, though, when it comes to fees. We will get into more fee-related detail later on in this review.

Before we get into the gritty details, there are some required legal disclosures here…..

This is an independent annuity product review. It is not a recommendation to purchase or to sell an annuity. Lincoln National Life has not endorsed this review in any way, nor do we receive any type of compensation for providing this review. This annuity review is meant solely to be an independent review at the request of our readers so that they may see our perspective when breaking down the positives and the negatives of this particular annuity. Prior to committing to the purchase of any type of insurance and/or investment vehicle, it is critical that you do your own due diligence, and that you also talk with a properly licensed professional if you have any questions that relate to your specific situation. All of the names, materials, and marks that have been used in compiling this annuity review are the property of their respective owners.

For additional information on how to compare annuities so that you can decide which may be the best on for you, in order to obtain our free annuity report.

How Lincoln National Describes the ChoicePlus Assurance Fee Based Variable Annuity Product

Lincoln National describes the ChoicePlus Assurance Fee Based variable annuity a variable annuity that offers the following benefits:

- Options for Growth Potential

- Guaranteed Income for Life

- Tax-Deferral

- Control and Flexibility

- Protection for Your Loved Ones

The ChoicePlus Assurance fee based variable annuity offers investors access to the Lincoln Elite Series of funds – which is a selection of professionally managed investment options. Some funds managed by the nation’s top investment managers are included.

As with other annuities, the growth inside of the account is allowed to compound on a tax-deferred basis, meaning that no tax is due on the gain until the time of withdrawal. Likewise, this annuity can also provide a guaranteed income for life – and it offers numerous options for receiving that income, as well as some optional distribution features such as living benefit riders for retirement income.

For instance this, and the other Lincoln ChoicePlus Assurance variable annuities offer the:

- Lincoln Lifetime Income Advantage 2.0

- Lincoln Market Select Advantage

- 4LATER Select Advantage

- Lincoln Max 6 Select

- i4LIFE Advantage

All of the Lincoln Life variable annuities also offer the Lincoln Long-Term Care Advantage rider. For more details on any of these riders, you can go HERE.

The ChoicePlus Advantage fee based variable annuity also offers protection for your loved ones via several death benefit options that may be chosen from.

This particular “A share” annuity can be issued as part of a fee-based financial plan, such as a managed account or a wrap account, whereby an investment firm or professional offers asset allocation and/or investment advice for a fee, as versus earning a commission on the products they sell you. Because of that, the up-front sales charge on this annuity are waived, and the annuity also charges a lower amount of mortality and expense (M&E) fees on the contracts that are issued as part of a fee-based financial plan.

How a Financial Advisor Might “Pitch” this Annuity

As this is a variable annuity, the Lincoln National ChoicePlus Assurance fee based product will likely be pitched by a financial advisor as a way to boost growth, as well as to diversify your investment allocations across a wide spectrum of options.

But none of these things take away from the fact that variable annuities still expose their investors to market related risk – and because of that, there is the distinct possibility that you could end up losing some of your hard-earned savings at a time when you are fast approaching retirement.

Plus, while you can certainly obtain a lifetime income from this product, that isn’t necessarily the main reason why people purchase variable annuities. Rather, these products are known more for providing a way to deposit additional funds into a tax-advantaged account (particularly when other tax-advantaged alternatives like an IRA and / or an employer-sponsored retirement account have already been “maxed out”).

In addition, even though the Lincoln National Life ChoicePlus Assurance fee-based annuity charges no up-front commission, don’t let that fool you into thinking that you won’t have any fees charged on this product. In fact, far from it.

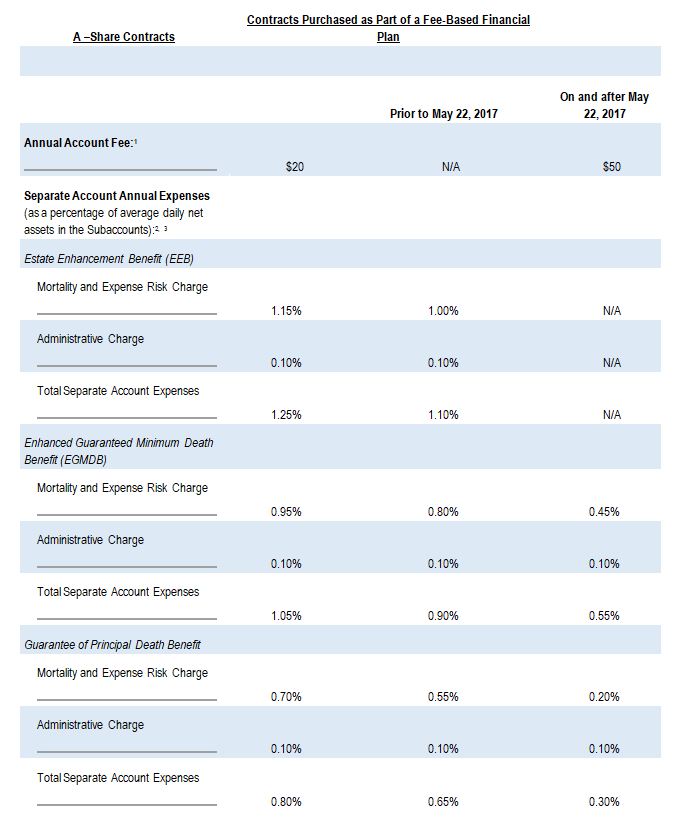

Fees Associated with the ChoicePlus Assurance Fee Based Variable Annuity from Lincoln Life

Although the ChoicePlus Assurance fee based variable annuity can be offered as part of a fee-based financial plan – and thus, charges lower fees – there is still quite a list of expenses that are incurred, and that can negatively impact your overall return.

According to the product’s prospectus, these include the following:

The Annuity Gator’s End Take on the Lincoln National ChoicePlus Assurance Fee Based Variable Annuity

Where it works the best:

- For those who want the opportunity for higher, market / ETF related returns.

- For those who are seeking a lifetime income

- For those who want their lifetime income to increase over time to help increase their future purchasing power

Where it works the worst:

- For those who don’t want to endure market-related risk

- For those who do not plan to use the lifetime income feature

In Summary

In analyzing any type of financial vehicle, it is important for investors to determine what their overall goals are. In some cases, for example, a product may appear to offer the “best of both worlds,” such as the opportunity for growth, along with a stream of lifetime income. Yet, it is essential when considering the product to also have a good understanding of what you may be giving up in order to attain such benefits.

In the case of the Lincoln National ChoicePlus Assurance Fee Based Variable Annuity, there are a number of key benefits that can be obtained, including the opportunity for market related growth, and diversification of your annuity related investments.

But along with this benefits can also come a long list of tradeoffs you need to consider, which include the exposure to market risk, as well as the fees and expenses that are involved, which could lower your overall return.

With this in mind, even if you are still leaning towards the purchase of this annuity, the only way to truly know whether or not it is the right annuity for you is to have it tested. We can do this for you, and can provide you with a synopsis of the results, based on your specific situation. If this is something that you are interested in having performed, then just simply contact us and will be happy to do this.

Any Additional Questions? Notice Any Mistakes?

We know that this annuity review went a tad bit on the long side – and for that, we truly thank you for sticking with us all the way through to the end. However, it is our thought that providing “too much” information on an annuity is far better than not providing enough – particularly when someone is trying to make a decision that can have life-long financial ramifications.

Given that, if you did benefit from the information in this review, then please feel free to share it by forwarding it to anyone you know that may also benefit from it. We are always happy to help others in determining whether or not a particular annuity may be right for them.

Also, if you happened to notice anything in this review that may be outdated or in need of revision, please let us know that, too and we will make the necessary updates as soon as possible.

Are there any other annuities that you would like to have us review?

If so, let us know the name of the annuity (or annuities, if there is more than just one), and our team of annuity geeks will get on it!

Best,

The Annuity Gator