What will we cover in this review?

In this review, we’ll cover the following information on the Pacific Life Pacific Index Edge Fixed Indexed Annuity:

- Product type

Fees

Fees- Current rates

- Realistic long-term return expectations

- How it is used

- How it is most poorly used

Annuities can be complex. That’s where having an Annuity Investigator who loves math comes in.

We make the complex, simple.

If you are currently in the process of looking for a financial vehicle that can provide you with the opportunity to earn market index-linked returns, while also keeping your principal safe and providing you with an ongoing income in retirement, then the Pacific Life Pacific Index Edge fixed indexed annuity could be a good option for you.

One big reason for that is because this annuity allows you the ability to earn a higher, index-linked, return than that of a regular fixed annuity. But if the market heads south, your hard-earned principal will still be safe. Plus, when the time comes to convert the annuity over into an income stream, choosing the lifetime income option will give you an ongoing, lifetime income – regardless of how long you live.

Yet, even though this might sound very appealing, don’t run to the nearest financial or insurance advisor quite yet and sign on the dotted line to purchase this annuity – at least not until you have a full understanding of how the product works, and how it may or may not work for you.

Over the past decade or so, annuities have become much more popular with investors as a way of getting a guaranteed, ongoing income stream in retirement – particularly because stock market performance can be so unreliable. Yet, this may not necessarily be a good thing because, even though most financial advisors work hard to do what is right for their clients, some of these sales agents may not be providing the best or most knowledgeable advice regarding these products.

On top of all that, because annuity products have risen so much in popularity lately, many insurance companies have been expanding their product lines with annuities that include lots of moving parts.

However, even though some of the annuities may allow you to “customize” what you do with your money, they can also be extremely confusing – even for well-informed investors. Also, you need to be careful in regard to the fees that are charged on some annuities, as these can really add up…as well as reduce the overall return that you ultimately receive.

With all of this in mind, it is highly recommended that you understand exactly what it is that you are committing to because locking yourself into an annuity could very well end up costing you in surrender penalties if you choose to get out of it.

This is where the Annuity Gator comes in!

Annuity and Retirement Income Planning Information that You Can Trust!

If you have never been to our website in the past, then please let us officially welcome you to AnnuityGator.com. We comprise a team of annuity experts who have a key focus on providing unbiased, and comprehensive, annuity reviews. We’ve been doing this for quite some time – and much longer than many of our competitors. Because of that, we have become a highly trusted source of annuity information online.

Throughout the past decade or so, there have been several “copycat” websites that have appeared on the scene. And, although some of these websites may be able to provide you with some basic information regarding annuity products, what you will most likely discover is that they are often just simply reiterating what the information on our website already shows.

If you have been spending any amount of time on the Internet trying to locate annuity information, then you may have come across some highly conflicting details about these products. This, however, is not entirely surprising, because there are many different annuities available today, and everyone seems to have an opinion about them.

It is possible, too, that in the recent past, you attended an annuity seminar where the presenter provided you with a free dinner or lunch, and then showed you how the Pacific Life Pacific Index Edge fixed index annuity (or some other similar product) works. You may have even moved forward with setting up a meeting with the presenter in order to determine whether or not this (or another) annuity will work, given your specific situation.

Our guess is that you are on our website right now in hopes of finding some additional information about the Pacific Life Pacific Index Edge annuity – and if so, then you are definitely in the right place.

Although many other websites may try to lure you in with the promise of high returns and low fees, here at AnnuityGator.com, you will discover all of the good, the bad, and also the ugly with regard to annuity products. This is because we feel that knowing the entire picture is really the only way to make a well-informed purchasing decision.

While we do feel that annuities can be a great product to add to your portfolio, this is really on the case if the annuity fits in well with your other short- and long-term financial goals and objectives.

So, if you’re ready to get started, let’s jump right in!

Pacific Life Pacific Index Edge Fixed Indexed Annuity at a Glance

| Product Name | Single Premium Immediate Annuity |

|---|---|

| Issuer | USAA |

| Type of Product | Single Premium Immediate Annuity (SPIA) |

| S&P Rating | AA+ (Very Strong) |

| Phone Number | (800) 531-8722 |

| Website | https://www.usaa.com |

Opening Thoughts on the Pacific Life Index Edge Fixed Indexed Annuity

Pacific Life has been helping clients to grow and protect wealth for nearly a century and a half. Throughout the years, this insurer has grown and expanded, both in terms of client base and assets under management.

The company held approximately $158 billion in total assets as of year-end 2017, as well as more than $11.2 billion in equity. With more than $9.4 billion in operating revenues and operating income in excess of $774 million, Pacific Life is more than able to uphold its promises to policyholders.

Because of its strong financial footing, as well as its timely payout of policyholder claims, Pacific Life has earned high ratings from the insurer rating agencies, including the following (as of 2018):

- A+ (Superior) from A.M. Best Company

- A+ (Strong) from Fitch Ratings

- A1 (Good) from Moody’s Investor Service

- AA- (Very Strong) from Standard & Poor’s

Pacific Life is currently ranked as #313 on the 2018 Fortune 500 list, based on its gross revenue. The company is also ranked as one of the world’s most ethical companies for 2019, and in 2018 earned a DALBAR Insurance Services Award.

Due in large part to the constant volatility of the market, fixed indexed annuities have become much more popular over the past decade or so. One reason for this is because these types of annuities can seemingly offer a “best of all worlds” scenario, including the safety of principal, the opportunity for index-linked growth, and a guaranteed stream of income in retirement.

Yet, while this may at first glance seem like an ideal way to go with your savings, if something sounds too good to be true, it typically is! Therefore, it is essential that you go over the “fine print” before you move forward with the purchase.

Before we get into the gritty details, here are some legal disclosures…

This is an independent product review, not a recommendation to buy or sell an annuity. Pacific Life Insurance Company has not endorsed this review in any way, nor do we receive any type of compensation for providing this review. This review is meant to be an independent review at the request of readers so that they may see our perspective when breaking down the positives and negatives of this particular annuity. Prior to purchasing any type of investment or insurance product, it is important that you do your own due diligence and that you consult a properly licensed professional if you should have any specific questions that relate to your individual circumstances. All names, marks, and materials that were used for this review are the property of their respective owners.

For more information on how to compare annuities in order to determine which one may be right for you, to obtain our free annuity report.

How Pacific Life Describes the Pacific Index Edge Fixed Indexed Annuity

In its product literature, Pacific Life Insurance Company describes the Pacific Index Edge annuity as a deferred, fixed indexed product that offers tax-deferred growth and the opportunity to attain a guaranteed income for life.

With this annuity, your principal will be protected – even in the event of a market downturn. Your money can also attain index-linked growth, based on how the underlying index(es) perform over time.

Plus, any interest gains that you get as a result of positive index performance are locked into the contract value – and they are also protected from any market downturns that may take place in the future.

The indexes that are tracked with the Pacific Index Edge annuity include the S&P 500, as well as the BlackRock Endura Index. You may also choose to place some – or even all – of your contributions into the annuity’s fixed account.

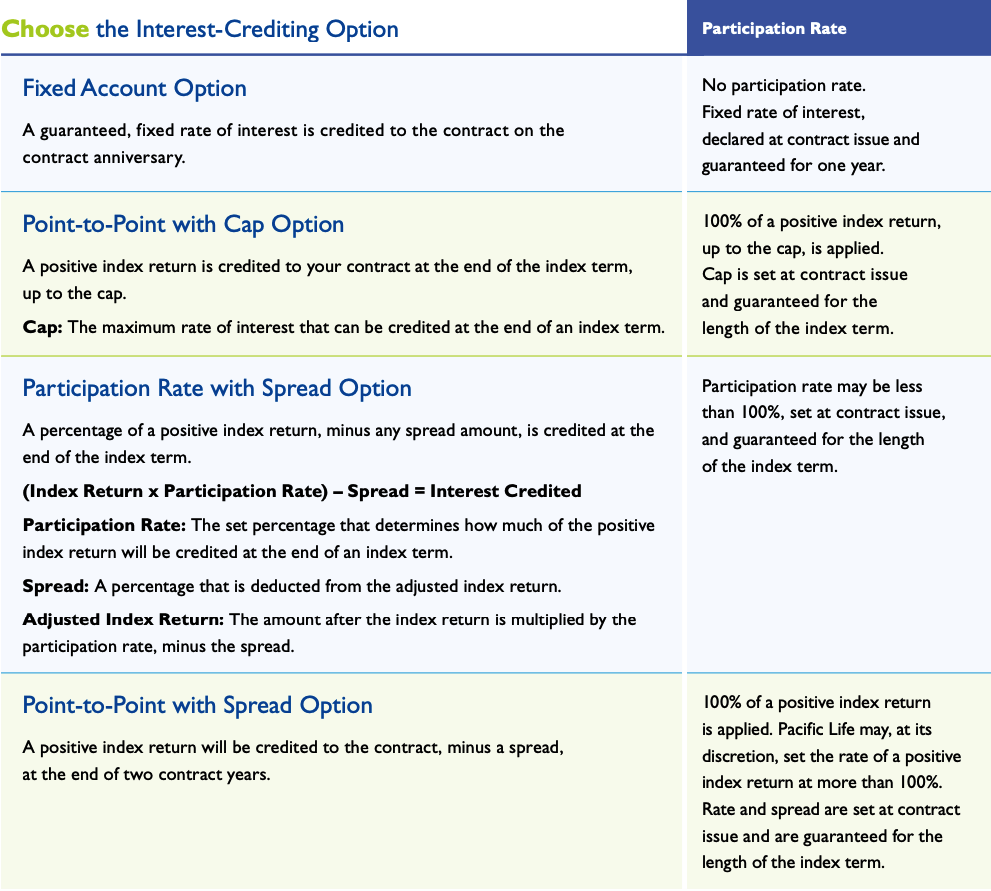

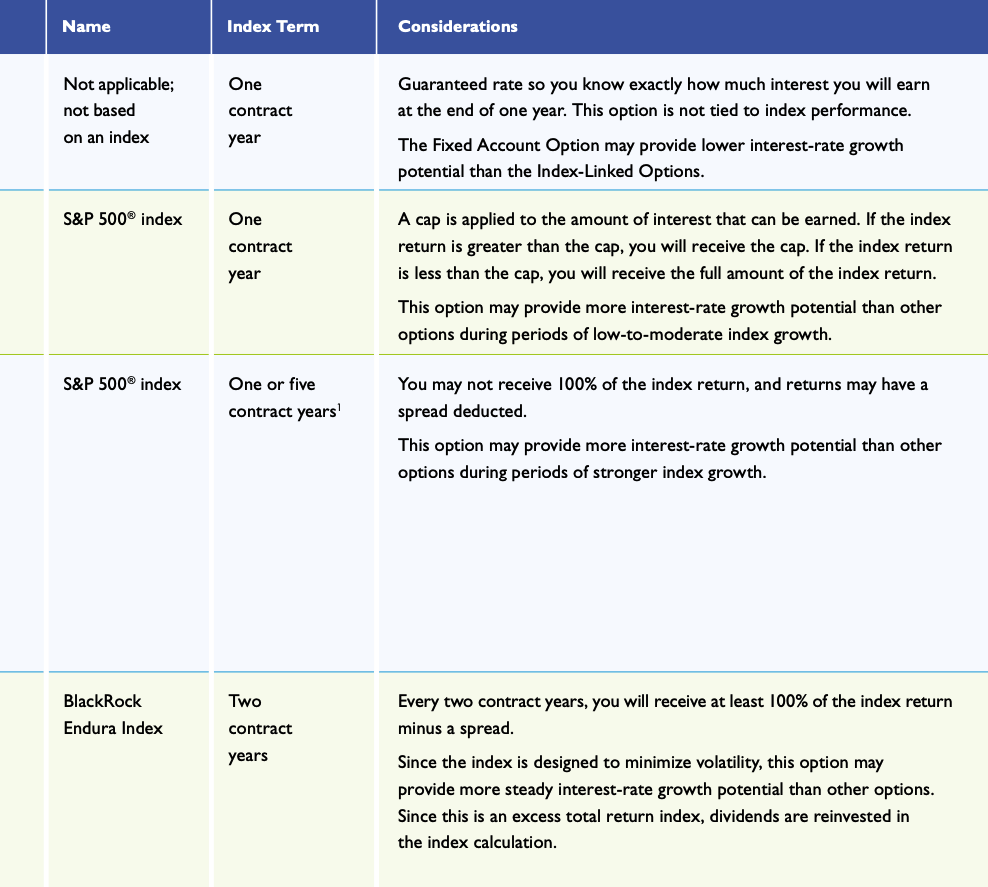

There is a variety of index crediting methods that you can choose from here. These include a fixed account option, as well as a point-to-point with cap, a participation rate with a spread, and/or a point-to-point with spread option.

The table below outlines all of these:

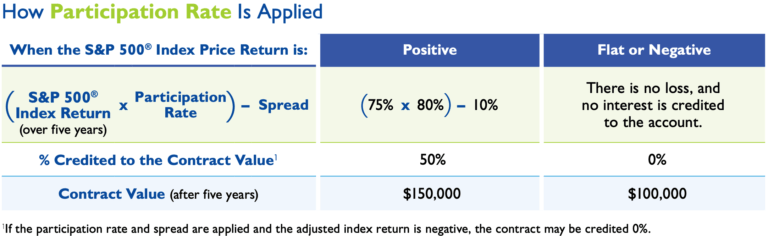

You can also check out how the participation rate is applied in this example:

There are some other “bells and whistles” that come with this annuity, such as a death benefit that is paid out to a named beneficiary (or beneficiaries), if the income recipient (i.e., the annuitant) dies before receiving back all of the contributions. (Note, however, that unlike a life insurance death benefit, the benefit that is paid out from an annuity is not income tax-free).

To check out all of the in-depth details, you can access the Pacific Life Pacific Index Edge brochure HERE.

How an Insurance or Financial Advisor Might Pitch this Annuity

Because it is a fixed indexed annuity, the Pacific Life Insurance Company’s Pacific Index Edge annuity can offer you the ability to obtain a higher return than a regular fixed annuity, yet without subjecting your money to the volatility of the stock market.

In this case, then, when the underlying index (or indexes) is/are up, a positive return will be credited. However, if the underlying index(es) suffers a negative return in a given time frame, your account will simply be credited with a 0%. So, while you won’t gain during those periods, you also will not lose – even if the indexed are down big.

As with other annuities, your account is allowed to grow on a tax-deferred basis, meaning that no tax will be due on the gain until the time of withdrawal. And, you can also choose from several different income payout methods – including a lifetime income option (which can erase your worry about outliving your income in retirement).

But even though this annuity may sound like it provides the best of all possible worlds, it is important that you know all of the ins and outs of how it works, not just the positive, rosy benefits that it offers.

For example, while you do have the opportunity to earn a higher return than that of a regular fixed annuity product, these returns are “capped”, and are not able to go beyond a certain level. This is one of the “tradeoffs” that need to be made in return for protecting your principal in down market environments.

In addition, if you need to access a certain amount (10%) of the contract’s value during the “surrender” period, you will incur a withdrawal penalty. The length of your surrender period will correspond with the rate guarantee period that is chosen. For instance, a 5-year rate guarantee will have a 5-year surrender charge period, and so on.

In addition to that, if you are under age 59 ½ if/when you make such a withdrawal, then you could also be hit with an additional 10% “early withdrawal” penalty from the IRS.

Pacific Life Pacific Index Edge Annuity Surrender Charge Schedule

| Product Name | Flexible Retirement Annuity (FRA) |

|---|---|

| Issuer | USAA |

| Type of Product | Flexible Premium Fixed Annuity |

| S&P Rating | https://www.usaa.com |

| Phone Number | (800) 531-8722 |

| Website | AA+ (Very Strong) |

Note that withdrawals can also reduce the contract value, as well as the value of the death benefit.

The Annuity Gator’s End Take on the Pacific Life Pacific Index Edge Fixed Indexed Annuity

Where it works best:

Although this annuity may not be the ideal option for everyone, it could be a good alternative if you are seeking the following features:

- The opportunity for higher growth than that of a regular fixed annuity product

- Protection of your principal

- Guaranteed income in retirement

Where it works the worst:

This particular annuity may not, however, work very well in all situations. This is especially the case if you:

- Want or need access to more than 10% of your money within the first several years

- Do not plan on using the lifetime income feature

In Summary

There is a long list of criteria that should be considered if you are thinking about purchasing an annuity. These should include – but they are not limited to – how the annuity can produce a return, how safe your money will be, how the income will pay out, and whether or not there are any other optional features that may be added to the annuity (as well as any added costs).

If you are considering the purchase of a fixed indexed annuity like the Pacific Index Edge from Pacific Life Insurance Company, you can be assured that your principal will be protected and that you will at least have the opportunity for obtaining a higher return than that of a regular fixed annuity product. You can also count on receiving a guaranteed income for life, provided that you choose the lifetime income option.

However, even with these great features, there might still be a better alternative for you and your particular objectives. But the only way to know for sure whether or not the Pacific Index Edge annuity is right for you is to have it tested. We can do this for you. So, in order to obtain this information, just contact us via our secure online contact form here.

Do You Have Any Additional Questions? Did You Happen to See Any Mistakes in this Annuity Review?

We realize that this annuity review was a tad bit on the long side. So, given that, we thank you for staying with us through to the end here. Our feeling is, though, that we would much rather provide you with “too much” detail than not nearly enough.

With that in mind, if you did find that this annuity review was helpful for you, then please feel free to forward it on to anyone else that you think may benefit from it. Alternatively, if this review led you to have even more questions, then please let us know that, too.

Are there any other annuities that you would like to see reviewed?

There are many, many annuity products available today in the market place – with new ones being offered all the time by the insurance companies that underwrite them. If you are interested in seeing a particular annuity reviewed that we do not already offer in our database, please let us know and our team of annuity “geeks” will be happy to provide that for you. Therefore, be sure to check back often for new and updated annuity information here.

Best,

The Annuity Gator

P.S If you would like to read more of our Pacific Life annuity reviews here are some links to check out:

- Independent Review of the Pacific Life Frontiers ll Fixed Deferred Annuity

- Independent Review of the Pacific Life Expedition Fixed Deferred Annuity

- Independent Review of the Pacific Life Secure Income Deferred Income Annuity as a QLAC

- Independent Review of the Pacific Life Core Protect Advantage Variable Annuity

- Independent Review of the Pacific Life Pac Mariner 7 Year Guaranteed Rate (MYGA) Annuity

- Independent Review of the Pacific Life Pacific Index Choice 6 Fixed Indexed Annuity

- Independent Review of the Pacific Life Pacific Frontiers II, 1 Year Guarantee Fixed Annuity

- Independent Review of the Pacific Life Pacific Odyssey Variable Annuity

- Independent Review of the Pacific Life Pacific Index Foundation Fixed Indexed Annuity