If you’ve been in the midst of researching retirement income products, then undoubtedly annuities have come across your radar. There are a number of positive features associated with annuities that can make them very attractive products.

But whether or not you should buy an annuity doesn’t depend on the product itself – even if it offers a long list of enticing bells and whistles. Rather, whether or not you should buy an annuity really depends on why you are considering it in the first place.

Is an Annuity Right for You?

Because everyone’s goals and dreams are different, not all financial products can produce the same results. In other words, what may be ideal for someone else, might be far from what you were hoping to achieve.

As an example, let’s look at fixed annuities. For some people, a steady rate of return that is set by the insurance company offering the annuity may be the ultimate cat’s meow – particularly if they are seeking the safety of principal.

But even though the money in a fixed annuity is safe – regardless of what occurs in the stock market – there are others who would gladly trade all of that safety for the opportunity to earn market-linked returns…even if it also means taking on the added risk of a volatile, or even a downward moving, market.

Do Your Financial Goals Align with What an Annuity Can Offer You?

So, what exactly are your financial goals?

Are you looking for the chance to earn a nice return quickly? Or instead, are you seeking a slow and steady upward moving account balance, regardless of what occurs in the stock market, or even in the economy overall?

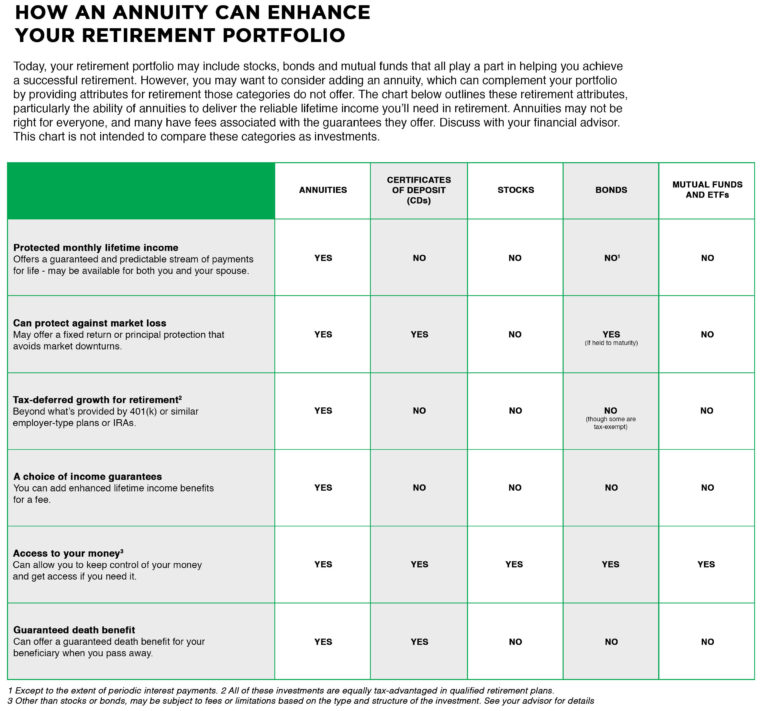

When you take a close look at annuities, these products essentially do three things very well. These are:

- Adding supplemental lifetime income

- Offering protected principal and/or growth potential

- Protecting funds for a loved one later on (i.e., legacy planning)

Adding Supplemental Lifetime Income

With all of that in mind, an annuity could be a consideration for you if you are looking to supplement your income in retirement, and the income that you will be receiving from Social Security and/or from other sources such as a pension will not likely cover all of your anticipated expenses.

In this case, you may find that you have what is referred to as an income “gap.” If, for instance, your anticipated retirement expenses will be $5,000 per month, but your combined pension and Social Security income only come to $4,000 per month, where will the other $1,000 per month that you need come from?

An annuity can provide you with the ideal solution. These products are designed for providing an income stream for a set amount of time – such as 10 or 20 years – or even for the remainder of your lifetime. Oftentimes, if you choose to go with a joint life income option, income from the annuity will continue for the remainder of your life, as well as for the life of another individual, such as your spouse, partner, or other loved one.

Growth Potential and Protected Principal

There are some annuities – namely fixed index annuities – that can provide you with the opportunity to earn a market index-linked return, while at the same time protecting your principal in the event of a market downturn.

While this might sound too good to be true, there are a few “tradeoffs” that you need to be mindful of if you opt to purchase a fixed index annuity. As an example, the amount of your positive return may be “capped,” meaning that there is a maximum amount of return your account will be credited with, no matter how high the underlying index goes up in a given year.

For many people who are nearing retirement, this give and take can be well worth it – particularly because you know that you won’t lose money if the market goes into a free fall. (Remember 2008?!)

Annuities and Legacy Planning

When it comes to leaving a legacy, an annuity can also provide you with some viable options. For instance, a legacy annuity has upside growth potential, while also keeping your account value safe.

Here, the funds are allowed to grow on a tax-deferred basis, and the money in the account may be left to a named beneficiary. Upon death, these funds will pass directly to the beneficiary, without having to go through the costly and time-consuming process of probate.

As an added benefit, unlike purchasing life insurance coverage, there are no health qualifications necessary in order to purchase the annuity death benefit. So, if you are doing legacy planning, then an annuity could certainly be something for you to consider – even if you have been turned down for life insurance protection in the past.

Your Personal Purchase Annuity Gauge

In the world of retirement income planning, there is no such thing as a one-size-fits-all strategy or product that is right for everyone. That being said, financial products like annuities should be considered tools to get you closer to your goal, as versus an all-encompassing solution.

So, in order to help you determine whether or not an annuity is really right for you, it can be helpful to ask yourself some important questions that pertain to your short- and long-term financial goals, and the best way that you want to go about achieving them.

If you still don’t have all of the answers you need regarding whether or not you should purchase an annuity, turning to an unbiased annuity advisor can help. At Annuity Gator, our primary focus is on investigating and comparing annuities.

Because of that, we have built up the largest source of annuity reviews online. We also assist consumers one-on-one in determining whether or not an annuity is really right for them – and if so, we walk through comparisons of different annuities in order to narrow down which one might be the best choice for you, given your specific short- and long-term financial objectives.

Want more information?

Feel free to reach out to us directly at (888) 440-2468, or go through our secure online contact form. We look forward to helping you determine whether or not an annuity is right for you.