What’s Covered in this American Equity Bonus Gold Annuity Review?

In today’s review, we’ll be covering the following information on the American Equity Bonus Gold Annuity with Lifetime Income Benefit Rider (LIBR). In order to truly understand this annuity and how it works, we will be going over:

- Product type

- Fees

- Current rates

- Realistic long term investment expectations

- How this annuity is best used

- How it is most poorly used

The American Equity Bonus Gold annuity is a fixed index annuity that also offers optional riders that can provide lifetime income guarantees. There are elements of this type of annuity that some conservative retirees and pre-retirees may find desirable, but there are also details that some sales agents might say about its potential performance that may not be entirely true.

So, before you go full steam ahead and complete an American Equity Bonus Gold annuity application, it’s important that you understand the differences (between what advisors say, and how the product really works), so you can determine if it really is a good fit as part of your financial plan.

Annuity and Retirement Income Planning Education You Can Actually Trust

For readers who have found this website for the first time and don’t know much about us, well, you have definitely come to the right place.

If you’ve been Googling “annuities”, it’s very likely that you’ve visited annuity marketing websites offering “Annuity Info Kits and DVDs” make the following bold claims in order to collect your contact information:

- Highest Payouts

- Lowest Fees

- Top Rates A+ Companies

- Guaranteed Income for Life

- Get Your Quote Now!

- Get 7-8% Returns with NO Market Risk

Sound familiar?

We’ve discovered that none of these “benefits” really even matter without first understanding your primary reason for buying an annuity in the first place. Furthermore, under further scrutiny, many of these annuities cannot actually provide 7-8% returns for most consumers.

Other websites are adamantly opposed to annuities but have no idea how they really work.

Both of those approaches are flawed and don’t benefit you in any way.

It is also possible that you have recently attended an annuity seminar hosted by a financial salesperson. In return for a “free” lunch or dinner, the annuity sales agent likely spent a considerable amount of time discussing annuities and all of their many benefits. Unfortunately, as the old saying goes, “There is no such thing as a free lunch.”

Here again, whoever invited you to the annuity seminar may be vying for you to schedule an appointment with them so that they could sell you an annuity.

Sadly, we chat with folks all the time, that have been steered into an annuity regardless of whether or not the product actually fit in with their financial goals.

Landing on the website you are on right now may have even been the catalyst that led you to obtain additional annuity information so that you could better understand how these financial vehicles work.

You will find that the site you are on today is totally different from the others. Here at AnnuityGator.com, we publish the most comprehensive independent and objective annuity reviews on the web – and we have been doing so for longer than any of the (now many) copycat sites out there…

So, you can ultimately decide for yourself if an annuity makes sense for you, or not.

Ready to learn the real truth about the American Equity Bonus Gold Annuity?

Great! Let’s dig in!

American Equity Bonus Gold Fixed Index Annuity – The Basics

| Product Name | American Equity Bonus Gold Annuity |

| Type of Product | Fixed Index Annuity |

| Issuer | American Equity Investment Life Holding Company |

| A.M. Best Rating | A- (Excellent) |

| Phone Number | 888-221-1234 |

| Website | www.american-equity.com |

Opening Thoughts on the American Equity Bonus Gold Annuity with Lifetime Income Benefit Rider (LIBR)

American Equity’s vision is to become the premier insurance company specializing in retirement savings and income products. This insurer offers a wide variety of annuities – including traditional fixed annuities, immediate income annuities, and fixed index annuities (or FIAs).

The fixed index annuities that are offered through American Equity use four common indexes to track performance. These include the:

- S&P 500 Index, which contains stocks from 500 different industry leaders, and is widely regarded as a leading benchmark for U.S. stock market performance.

- S&P 500 Dividend Aristocrats Daily Risk Control 5% Index – This is a volatility control index that offers increased stability and control based on companies with 25 consecutive years of positive dividend returns. The index is dynamically adjusted across two components: equity and cash. It is also well diversified across all market sectors.

- Dow Jones Industrial Average (DJIA) – The DJIA is the oldest continuing stock market index in the world. Many of the stocks that are represented in the DJIA are leaders in their industries.

- 10-Year U.S. Treasury Bond – The 10-Year U.S. Treasury Bond is a government-issued debt that is designed for mirroring general market interest rates.

For more in-depth details on the American Equity annuity indexes,

go HERE.

American Equity Investment Life Insurance Company is a subsidiary of American Equity Investment Life Holding Company, a New York Stock Exchange Listed company that is headquartered in West Des Moines, Iowa. It is a top seller of annuities, with more than 600,000 annuity holders and over $50 billion in total assets.

According to American Equity, the company “does not have big stadiums with the American Equity logo on them, and they don’t buy pricy television advertising or have a funny mascot. What they do have that puts them ahead of the competition is a commitment to conservative investment practices that keep your money safe, and customer service that cannot be outperformed.”

For quite a few years, many people purchased fixed index annuities because these products were pitched as a way to get market linked upside with no market downside.

However, with interest rates being historically low over the past decade or so, the upside on these products has been severely limited.

As a result, many insurance companies have pivoted to make their products more about lifetime income guarantees that account holders cannot outlive. In terms of index annuities, many have done this by adding “riders” that add an income benefit to the original chassis.

While most insurance companies aren’t fond of the term, there are quite a few agents that use the term “hybrid annuity” when describing this updated version of the original index annuity. Be careful though with this term. “Hybrid Annuity” is just a marketing term. It’s nothing special and in reality annuities (for the most part) have always been hybrid in nature (they do more than just one thing).

In the case of the American Equity Bonus Gold product, it comes with the option to choose from a few variations of their Lifetime Income Benefit Rider (LIBR). Let’s take a closer look at how this rider actually works.

American Equity Bonus Gold Lifetime Income Benefit Rider

The LIBR essentially guarantees a lifetime income for the contract owner regardless of how long the owner lives or what the market does. Even if the underlying investments go to zero, the LIBR keeps on paying income. If the annuity owner defers this rider the future income is higher based on a “roll-up rate.”

A roll-up rate though is not an actual return. This is supremely important.

Income riders like the LIBR have been really popular largely because of the volatility of the stock market, and also because low-interest rates have made it tough to find high paying fixed investment alternatives.

The problem though is the actual returns of these riders is easily misinterpreted. The bonus rates, roll up rates, and distribution rates are NOT the real returns to the investor.

In order to truly get an idea of whether or not a fixed indexed annuity such as the American Equity Bonus Gold annuity is right for you,

click here so that you can access our free annuity buyer’s guide.

If you’re wondering if this annuity is right for you, or if you have questions and need a little help getting pointed in the right direction; just reach out via our

secure contact form here.

Before we get into the gritty details, here are some legal disclosures…

This is an independent product review, not a recommendation to buy or sell an annuity. American Equity has not endorsed this review in any way nor do I receive any compensation for this review. This review is meant to be an independent American Equity Bonus Gold review at the request of readers so they could see my perspective when breaking down the positives and negatives of this particular model annuity. Before purchasing any investment product be sure to do your own due diligence and consult a properly licensed professional should you have specific questions as they relate to your individual circumstances. All names, marks, and materials used for this review are the property of their respective owners.

How American Equity Describes The Bonus Gold Annuity

Based on the information that is outlined in the American Equity Bonus Gold Annuity

brochure, the key highlights of this annuity include:

- Safety of Premium

- Deferral of Income Taxes

- Avoidance of Probate

- Liquidity

- Guaranteed Income

- Flexible interest crediting options

There’s a few more bells and whistles, but those are the basics. If you’re looking for the full brochure, you can find it

here.

Based on the additional information that is also provided by

American Equity regarding the LIBR, this too is touted to provide a number of benefits, such as:

- Lifetime Income

- Control of the money that remains in the annuity

- The choice of a Rate / Benefit option that best suits your specific needs

- An available spousal income benefit

- Level or increasing payment options

You may also find that the American Equity Bonus Gold annuity offers additional features, like a

Wellbeing Rider. These riders can be beneficial – provided that they fit in with your specific financial goals. It is always important to keep in mind that there are no one-size-fits-all retirement savings or income solutions, so checking out a product thoroughly is the best route to take before committing a large chunk of your retirement savings…especially because once you’ve purchased an annuity, it can be difficult, and costly, to get back out.

For more in-depth information regarding the Lifetime Income Benefit Rider (LIBR), as well as the other options related to the American Equity Bonus Gold annuity, you can find that

here.

The American Equity Bonus Gold is a lot like other annuities that annuity sales agents call a hybrid annuity. In the past few years, some insurance agents have fallen in love with the term “hybrid annuity.” Even though the insurance companies don’t seem to like the term a whole lot, I guess the cool sounding name makes it easier to sell annuities, so it’s caught on nonetheless. When agents use the term “hybrid,” they are referring to an annuity that has multiple annuity features rolled into a single product.

In the case of the American Equity Bonus Gold Annuity, it combines a lifetime income guarantee with the possibility of higher returns linked various market linked crediting methods; hence some advisors may call it a hybrid annuity.

If you hear it described as a “hybrid annuity” – there are a few different ways it might be presented. Our experience, however, is that most sales agents will focus on two main components:

- The safety combined with return potential of the bond market

- The guaranteed income for life (LIBR) that makes the worst case scenario pretty desirable

While those are true statements, this annuity is not perfect (nor all bad). It can work well when used correctly but has shortcomings just like any other financial product. One of the biggest issues I’ve run into is that many agents misrepresent how this annuity will actually perform. That’s a problem.

From the many people we’ve talked to personally about their experience with agents,

many have been told this annuity will perform “better” than other annuities. Because the roll-up rate on LIBR can be as high as 6.0% per year, and the payout rate can be over 5%, some people seem to think that is the actual return. Combined with a potential bonus of 10%, it is easy for many to think their worst case return will be more than 5% per year.

Is any of that true? Eh, not exactly.

If your financial salesperson explains this annuity correctly, you should never get the impression you’ll earn more than 6% (in today’s low-interest rate environment). Based on our testing, we feel that the most realistic expectation is closer to the 2% to 5% range.

And, it could actually only produce a return of less than 1% – and if you happen to cancel the annuity before the surrender period ends, you could actually end up losing money!

If bigger returns than that are part of your agent’s sales pitch, then RUN, don’t walk, to find a more honest financial advisor.

Unfortunately, even though most insurance and financial professionals work hard to do what is right for their clients, because index annuities have so many “moving parts,” there may be some insurance sales agents in the field who do not fully understand how they work – and in turn, they end up providing their clients with incorrect information, and incorrect expectations of how these products work.

If you really don’t know the person who offered you this annuity – or, even if you just want to do a bit of a background check on your financial advisor – you can easily do so by going to

Brightscope and entering in your advisor’s name, city, and state. Doing so can provide you with a sense of relief if they check out ok, or a reason to find another advisor if they don’t.

The reality is that the only real way to determine if the American Equity Bonus Gold annuity – or any annuity, for that matter – may be right for you, is to use an annuity calculator that takes into account your specific situation, time frame, and other factors about YOU. To go to our American Equity Bonus Gold annuity calculator, and to receive a free spreadsheet that can help you in making your decision,

just click here.

American Equity Bonus Gold Commission and Other Fees

As with any other annuity issuer, American Equity incurs expenses for the selling and the issuing of its contracts – which can include the payment of a commission to insurance or financial advisors. The good news is that this commission won’t come directly out of your deposit into the annuity.

Where you do need to be careful, though, is with the potential charges that you could incur if you withdraw more than 10% of your contract’s value during the surrender period – and in this case, it’s a long one!

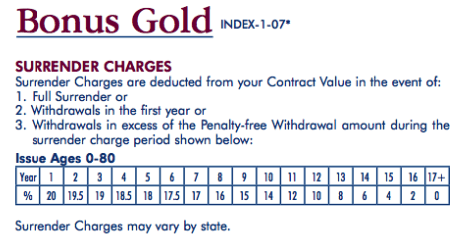

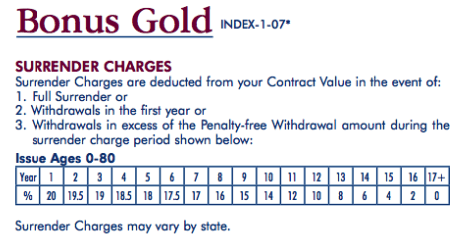

With this annuity, you are essentially “locked in” for 17 years. Here is a schedule of the year-by-

year American Equity Bonus Gold Annuity surrender charges:

With that in mind, be sure that you understand that the American Equity Bonus Gold annuity – and quite frankly, any annuity – is a long-term financial commitment. So, the money that you put into this product should be funds that you won’t need any time soon in the event of an emergency.

The Annuity Gator’s End Take on the American Equity Bonus Gold Annuity Review

Where it works best:

- For producing a reliable, “pension-like” guaranteed income stream (although there are other annuities with higher guaranteed income at this time)

- For producing an income for life that cannot be outlived by a surviving spouse

- For investors who have a family history of life longevity

- For investors that have no need for their money or generating large returns, but want it to grow safely until transferred to their beneficiaries

- For investors that want increasing income payments via an inflation adjustment to the LIBR

- For investors willing to defer income payments from the annuity for 5 years or longer in order to get maximum benefit from the LIBR rider

Where it works worst:

- For those that do not plan on using the Lifetime Income Benefit Rider (LIBR)

- For those seeking maximum long-term growth

- For those who need access to more than 10% of their cash within 17 years after purchasing this annuity

We should also note that we only tested a few of the many ways this annuity can be structured. It has other indexes that the interest can be calculated against, as well as some different options on the income rider, and most importantly – the returns will vary based on each unique person’s circumstances.

In general, though, this is a fairly comprehensive review of the American Equity Bonus Gold that will hopefully help many people to better understand how this annuity works.

For even more detail, you can also check out the American Equity Bonus Gold annuity prospectus, as well as additional literature that provides more in-depth information on this particular annuity.

Summary

One of the most important things for investors to understand is that the “income growth rate” is not the actual return, nor is the “income percentage” the actual return.

It’s highly unlikely that it produce the 5% to 8% return numbers some may use when trying to sell it (NOTE: there are regulatory requirements surrounding product training and disclosure of product information agents should be adhering to. If they do not, it is not at the fault or responsibility of the issuing insurance company).

For someone strictly looking for guaranteed income with no market risk, the American Equity Bonus Gold can do the job,

though there may be better options available. For someone looking for an investment vehicle that cannot go down, is content with low to mid-single digit returns, and wants the transfer of risk annuities are really good at – this might be a good fit.

In the end, we’re still convinced some agents don’t realize what the real returns are though, and may significantly over-promise what’s realistic – so be especially wary of anyone who suggests this annuity will work better than how it is illustrated here.

If the agents are being upfront and honest, you’ll notice their explanations match very closely (if not exactly) as described in this review. When that happens, you have an agent you can trust. American Equity has actually done a very good job of producing easy to understand literature and in no way misrepresenting their product. They can’t, however, control every word that comes out of every agent’s mouth – so buyer beware!

The only way to know if this annuity is a good fit for you is to have it tested. We do this free at AnnuityGator.com, so just get in touch with us and we’ll use the

proprietary software to illustrate for you what returns for your situation are likely to be. If your agent was honest with you the numbers will match up – if not, well then you might want to reconsider who your agent is.

Have Questions on the American Equity Bonus Gold Annuity? See any Mistakes?

If you have any additional questions regarding the American Equity Bonus Gold Annuity with LIBR – or questions or concerns about whether or not any other annuity may be the best fit for you – then please feel free to reach out to us via the

Free Annuity Help form here.

We realize that annuities can be somewhat confusing – even for well-informed consumers (and insurance agents!) There are a lot of agents who are pushing investors very hard to buy them.

But you really need to know the real facts to make sure if you go that route, you don’t end up regretting it later.

After all, annuities are long-term investments with contracts, surrender penalties, etc. For some people, they won’t make sense at all, but for some, they might.

If you know anyone who has an annuity or is thinking of buying one, please share this post with them. We know a lot of people are getting very conflicting information and our goal in writing this review was to educate in an objective way.

If you have a Facebook account you can click on the little “Facebook” icon and share this article. That way more people will be able to find it and hopefully, more people will benefit.

Thanks for bearing with us on this rather long post, we hope you found it beneficial in your research.

Lastly, like all humans – we do make mistakes. If you see one on this review please reach out and let us know. We’re always more than happy to make corrections and give credit where it is due. If you’re an investor and this

American Equity Bonus Gold review causes confusion and creates questions

feel free to reach out as well. Our team of annuity geeks can clear up those questions within a day or two.

Have Another Annuity You’d Like to See Reviewed?

No problem. Our team of highly trained annuity geeks can jump on it!

Click here to get started and we’ll do our best to get it online as soon as possible.

Have a Question?

If you ever need to ask specific questions or need some one-on-one guidance (for free and with no pressure, of course), feel welcome to reach out by

clicking here. We’d love to hear from you.

Best,

The Annuity Gator

P.S. We included a few more related links to the American Equity Bonus Gold below that you might find useful:

P.P.S If you would like to read more of our American Equity annuity reviews here’s some links to check out:

With that in mind, be sure that you understand that the American Equity Bonus Gold annuity – and quite frankly, any annuity – is a long-term financial commitment. So, the money that you put into this product should be funds that you won’t need any time soon in the event of an emergency.

With that in mind, be sure that you understand that the American Equity Bonus Gold annuity – and quite frankly, any annuity – is a long-term financial commitment. So, the money that you put into this product should be funds that you won’t need any time soon in the event of an emergency.

Andrew Brown,CFP®

Jason,

Great job. I’ve used your review in helping my client understand the sales speak. Skyscrapers weren’t built on transparency. Your site helps shine a light where much light is needed.

Annuity Gator

Andrew, thanks for the positive feedback! Glad to be of help and best of luck.

-Annuity Gator Team

Judy

Thanks for the article. I am looking at this annuity and this helped. I clicked on “Get our annuity E book” free and nothing happened. Help?

Annuity Gator

Hi Judy,

Thanks for bringing this up. We’re having a couple issues with the submit button that just started a couple days ago for no apparent reason. Our tech team is looking into the fix right now and hopefully we’ll have it back up and running soon!

Best,

-Annuity Gator

Ali

I am trying to sign up for free annuity book but nothing happens.

Doug Roach

Jason: You mentioned that there may be better options available than the “Bonus Gold” product.

Can you give me a couple so I can review them?

Many thanks – your review was great.

Doug

Dave

Read your article and watched the video and then went back to my FA with some questions. I asked to see performance results, saying your analysis indicated 1-4% annually was what could be expected. He provided me with their results from 7/1/05 – 7/1/13 which, obviously, covers the recession timeperiod. However, some results showed higher returns then I expected based on your video, up to 13.9% for 7/1/07 and 12,7 % for 7/1/11, for example. I’d like to send this to you for further comments, if possible.

Kurt

Jason,

I too tried to order your EBook and nothing happened.

Tongia

Thank you for this valuable information.

Bob Leibman

Just tried getting that same booklet and nothing happens – still.

Bob Leibman

Jim

Jason,

I have two American Equity contracts. One is the Bonus Gold and the other is the Retirement Gold. I purchased the Bonus Gold first. When I went to purchase the second contract, my agent advised me to buy the Retirement Gold. He told me that, although the Retirement Gold had a smaller bonus, the surrender terms were better. So, I followed his advice. Unfortunately, I have since realized that the Retirement Gold has inherent lower caps. I’m not happy. Any idea why he would have pointed me in that direction?

Wayne Cushing

Hi, I talked to a sales rep today about this particular product and he pitched a proposal to me. Basically, he was suggesting that I take the 200K that I have invested in the TSP/G Fund and my Vanguard account and roll it over into this annuity. I am 67 now. My current plan was to let the Vanguard account grow while I withdraw money from my TSP/G Fund and then when I get within 5 years of depleting the G Fund, transfer money over from my Vanguard account. I get a federal pension, too, which provides me with a reliable source of income. I don’t think I need an annuity but was intrigued with this sales person because I had heard him speak on the radio and I always thought ;”Boy…this sounds too good to be true”…so I went to a free luncheon to listen to him. Anyhow , You indicated there were better fixed index annuity plans out there. Could you share with me what they are and why you like them ?

Thanks, Wayne

Bruce Horwitz

Hi Jason

Tried to sign up for your free booklet, by entering my email address in proper place, then I hit tab, and moved cursor to where I got the “pointy finger” – nothing happened; i.e. the cursor is just blinking –

Is it me? If not please provide

Thank you it

PS Loooks like a very good website

Janet Lasota

If this is not the best, which ones are you suggesting?

tbird

I also tried to download the “Get Our Annuity E-Book Free” doc and was unable to access it.

Frank Ortiz

Thanks for the info… in the process of getting an Amer Equity BGA with LIBR. As u stated ….. for life time income not a bad plan… but the interest rate is very disappointing… can u explain how the JOINT annuity works if I die before/after pay outs begin. Can my spouse continue with the annunity under the same terms/LIBR. How do u feel about US saving bonds??? U mentioned there r better annuities available??? What r they. Thanks

Kathy

My mother is 78 and we have rolled money into a American Equity Bonus Gold. She has now been approached by Edward Jones and is considering moving it there.

Can you tell me the difference and what will be best at her age.

Thanks

John Bellingham, CFP

Well done. I had a follow up question that I sent to you via the comments feature of your site. If you have a moment to respond that would be appreciated.

Jo Walker

Thank you for this in-depth, easy-to-understand review. I am in the process of purchasing it for the reasons you mentioned in “where it works best;” and that was what really helped me to make the final decision. I am so happy that I found you, dear annuitygator. I send you good wishes for all the paying clients you can handle.

Jean Reiser

what other insurance companies that offer annuities with a higher interest rate with LIBR would you reccommend? I think I would prefer a higher rate than Am Equity offers.and I don’t like the BBB rating Thank you for your superb video .

Richard Eichinger

I have this product since 2010 and take a 7% draw is this what I should stay with or look for a better product . I am 66 ! thanks

Tom Feeney

I glanced at this Article the other day and saw that there was a 40 minute or so video that could be linked from the Article. I didn’t have time at that first visit to look at the video but made a mental note to come back and look. I did so today and although there is a reference in the article to the video, the link seems to be gone. Did I miss something???

Ric Aielli

very good info, Thanks

Earl Harmer

Very interesting site, hope to listen again. We have lots of questions for you. Thanks

James Peoples

I am 70 years old and have fixed annunities with Horace Mann. I was thinking about rolling over to American Equity. Would that be better or stay with what I have at 4 1/2 percent?

James Peoples

Which is better Horace Mann or American Equity

Earl McGinn

Is the video on American Equity Investment Bonus Gold still available to watch on your site? If so, how do I access it?

Kass

I did not find a link to the 40 minute video. Can you send it? Thanks. Nice review. Very informative.

Mitchell Maloney

I can’t figure out how to access any video that you mention above that is supposed to be 45 minutes long. Am I missing something?

Mitch

Louis Valkenaar

Where is the video? Can’t find a link to the American Equity Gold video on your review page. Thanks!

hartel bascombe

I have a Variable Annuity with Jackson Insurance since May 2010, Perspective L Series with Lifeguard Freedom 6 DB. I plan on taking income in 6 years at age 75, when the GWB will be 200% of my initial premium of $112,324, as long as I have made no withdrawals. My account balance is in the $149,000 range and my roll up is 6%.

I am being urged by agents from American Equity and North American to transfer to a Fixed Index Annuity and be guaranteed a higher life time payment in 5 years using Retirement Gold I-4-10Lb14 with 8% bonus and 7% Income Rider and NAC retire Choice 14, with 8% bonus and 6.75 Income Rider. If I had read your E-book 5 years ago, I would not be in this situation. Please advise whether I should keep my Variable Annuity or change to a Fixed. Your opinion is valued.

Dennis Jones

No link to video.

Jay

I could not get to the video. Where it is?

Vicki

I am the beneficiary of a ‘bonus Gold annuity owned by father. He passed last week, Can you explain the income tax consequences of the distribution. My mother is beneficiary of another of these annuities, what income tax consequences will she have?

Thank you

Carl Voorhees

Where is the link to the video? It seems to have disappeared. 1/19/2017

Annuity Gator

Hi Vicki – Thank you for your email. Overall, when someone inherits an annuity, tax would need to be paid on the gain. So, depending on whether the funds in that annuity were from your father’s retirement account (such as a 401k plan) or a Traditional IRA, or if they were funds that were from a regular savings or investment account, this will determine just how much is actually taxed. This would be the case whether the money was received by you as a lump sum or in a series of payments. The tax consequences of annuity payouts are that the amount that is considered gain will be taxed as ordinary income at your income tax rate. Please feel free to contact us directly if you would like additional information. We can be reached at (888) 440-2468. Best. Annuity Gator Team

Annuity Gator

Hi Carl – Thank you for your message. There were some updates that needed to be made on that particular review. So, while the video is no longer available, there are updates posted on the review under the heading of *Review / Video Updates.* Hope this helps, and please let us know if we can answer any additional questions. Best. – Annuity Gator Team

Annuity Gator

Hi Jay – Thank you for your message. There were some updates made to that particular annuity review. While there is no longer a video on the review of the American Equity Bonus Gold with LIBR, you can access the updated details under the heading of *Review / Video Updates* by going here: http://www.annuitygator.com/independent-review-of-the-american-equity-bonus-gold-annuity/?utm_source=Independent%2BAnnuity%2BReviews&utm_medium=Page&utm_term=&utm_content=Annuity%2BReview%2BDatabase&utm_campaign=Independent%252BAnnuity%252BReviews%2B-%2BAnnuity%2BReview%2BDatabase Please let us know if we can help further. Best. – Annuity Gator Team

Annuity Gator

Hi Louis – Thank you for your message. There were some updates made to the American Equity Bonus Gold annuity review. While the video is no longer available for this particular annuity, you can access the updated information under the heading of *Review / Video Updates* that is about midway down the page. The review can be found by going here: http://www.annuitygator.com/independent-review-of-the-american-equity-bonus-gold-annuity/?utm_source=Independent%2BAnnuity%2BReviews&utm_medium=Page&utm_term=&utm_content=Annuity%2BReview%2BDatabase&utm_campaign=Independent%252BAnnuity%252BReviews%2B-%2BAnnuity%2BReview%2BDatabase Please let us know if we can help further. Best. – Annuity Gator Team

Annuity Gator

Hi Mitch – Thank you for your message. There were some updates made to the American Equity Bonus Gold annuity review. While the video is no longer available for this particular annuity, you can access the updated information under the heading of *Review / Video Updates* that is about midway down the page. The review can be found by going here: http://www.annuitygator.com/independent-review-of-the-american-equity-bonus-gold-annuity/?utm_source=Independent%2BAnnuity%2BReviews&utm_medium=Page&utm_term=&utm_content=Annuity%2BReview%2BDatabase&utm_campaign=Independent%252BAnnuity%252BReviews%2B-%2BAnnuity%2BReview%2BDatabase Please let us know if we can help further. Best. – Annuity Gator Team

Annuity Gator

Hi Kass – Thank you for your message. There were some updates made to the American Equity Bonus Gold annuity review. While the video is no longer available for this particular annuity, you can access the updated information under the heading of *Review / Video Updates* that is about midway down the page. The review can be found by going here: http://www.annuitygator.com/independent-review-of-the-american-equity-bonus-gold-annuity/?utm_source=Independent%2BAnnuity%2BReviews&utm_medium=Page&utm_term=&utm_content=Annuity%2BReview%2BDatabase&utm_campaign=Independent%252BAnnuity%252BReviews%2B-%2BAnnuity%2BReview%2BDatabase Please let us know if we can help further. Best. – Annuity Gator Team

Annuity Gator

Hi Earl – Thank you for your message. There were some updates made to the American Equity Bonus Gold annuity review. While the video is no longer available for this particular annuity, you can access the updated information under the heading of *Review / Video Updates* that is about midway down the page. The review can be found by going here: http://www.annuitygator.com/independent-review-of-the-american-equity-bonus-gold-annuity/?utm_source=Independent%2BAnnuity%2BReviews&utm_medium=Page&utm_term=&utm_content=Annuity%2BReview%2BDatabase&utm_campaign=Independent%252BAnnuity%252BReviews%2B-%2BAnnuity%2BReview%2BDatabase Please let us know if we can help further. Best. – Annuity Gator Team

Annuity Gator

Hi Tom – Thank you for your message. There were some updates made to the American Equity Bonus Gold annuity review. While the video is no longer available for this particular annuity, you can access the updated information under the heading of *Review / Video Updates* that is about midway down the page. The review can be found by going here: http://www.annuitygator.com/independent-review-of-the-american-equity-bonus-gold-annuity/?utm_source=Independent%2BAnnuity%2BReviews&utm_medium=Page&utm_term=&utm_content=Annuity%2BReview%2BDatabase&utm_campaign=Independent%252BAnnuity%252BReviews%2B-%2BAnnuity%2BReview%2BDatabase Please let us know if we can help further. Best. – Annuity Gator Team

Annuity Gator

Hi Dennis – Thank you for your message. There were actually some updates that were made to the American Equity Foundation Gold Annuity with Income Rider LIBR 6%. The video is no longer on this particular review, but you can find the updated information on this annuity here: http://www.annuitygator.com/american-equity-foundation-gold-annuity-with-income-rider-libr-6-review/?utm_source=Independent%2BAnnuity%2BReviews&utm_medium=Page&utm_term=&utm_content=Annuity%2BReview%2BDatabase&utm_campaign=Independent%252BAnnuity%252BReviews%2B-%2BAnnuity%2BReview%2BDatabase Please check back in again soon. Best. – Annuity Gator Team

Annuity Gator

Hi Hartel – Thank you for your message. We would be happy to walk you through some different scenarios, and to discuss whether or not you should keep your VA or switch over to a fixed annuity option. In order to provide you with the best possible advice, we would actually need to get some additional information from you. Rather than emailing personal details back and forth, though, it would likely be best to discuss via phone. Please contact us, toll-free, at (888) 440-2468. We look forward to talking with you. Best. – Annuity Gator Team

Annuity Gator

Hi James – Thank you for your message. The better company (and in turn, annuity products) will really depend on what it is that you are looking for the annuity to do, as well as your goals, age, and retirement time frame. We would be happy to discuss in more detail with you so as to determine which would be best for you. Please feel free to contact us directly via phone at (888) 440-2468. We look forward to talking with you. Best. – Annuity Gator Team

Annuity Gator

Hi James – That depends on several factors, including the surrender period on your current Horace Mann annuities, as well as your overall goals. In order to provide you with the best information, we would actually need to obtain some additional details from you. But rather than sending this sensitive information back and forth via email, it would be best to discuss by phone. Please feel free to contact us directly, toll-free, at (888) 440-2468. We look forward to talking with you. Best. – Annuity Gator Team

Annuity Gator

Hi Ric – Thank you for your comment. We appreciate your kind words. We are continuing to add more annuity reviews to our site, as well as updating the current reviews in order to stay current on their information. So, please feel free to check back often. Best. – Annuity Gator Team

Annuity Gator

Hi Jo – Thank you so much for your comment. We’re glad to hear that you found the review helpful. We are always updating and adding additional annuity reviews to our website, so please feel free to check back often. Also, if you have any additional questions regarding your annuity that you would like to discuss with one of our experts, please call us toll-free at (888) 440-2468. Best. – Annuity Gator Team

Annuity Gator

Hi John – Thank you for your message. We would be happy to talk with you and answer any of the questions that you may have about the American Equity Bonus Gold annuity. Please feel free to contact us directly at (888) 440-2468. We look forward to speaking with you. Best. – Annuity Gator Team

Annuity Gator

Hi Kathy – Thank you for your message. If you still need information regarding your mother’s American Equity Bonus Gold, please feel free to contact us directly via phone. We will then be able to provide you with more in-depth information, and also to run some different scenarios. We can be reached toll-free at (888) 440-2468. We look forward to talking with you. Best. – Annuity Gator Team

Annuity Gator

Hi Richard – Thank you for your message. The American Equity Bonus Gold annuity may well be a good product for you. However, that depends on your specific goals, income needs, etc., as well as how much of the surrender period is still left on the contract. (In some cases, though, it can make sense to move over to something else that will perform better for you). In order to really give you the best answer, we would need a bit more information from you. Rather than emailing sensitive personal details back and forth, though, it would be best to discuss via phone. Please feel free to call us directly at (888) 440-2468. We look forward to chatting with you. Best. – Annuity Gator Team

Annuity Gator

Hi Janet – Thank you for your message. The best option will really depend on your specific situation, and on what you want the annuity to do (such as potential return, future income stream, death benefit, and / or funds for a possible long term care need). We would be happy to go over some possible alternatives with you. In order to provide you with the best advice, though, we would need to get some additional details from you. Rather than emailing this information back and forth, it would likely be best to discuss via phone. Please feel free to contact us directly, toll-free, at (888) 440-2468. We look forward to speaking with you. Best. – Annuity Gator Team

Annuity Gator

Hi Dave – Thank you for your message. We would be happy to discuss the American Equity Bonus Gold annuity in more detail with you. At your convenience, please feel free to reach out to us directly via phone at (888) 440-2468. We look forward to hearing from you and answering your questions. Best. – Annuity Gator Team

Annuity Gator

Hi Doug – Thank you for your message. We would be happy to discuss various alternatives with you. In order to provide you with the proper information, though, we would need to get a few more details from you. That way, based on your financial goals, time frame, etc. we can offer you the best advice. Rather than emailing back and forth sensitive personal information, it would be best to discuss via phone. At your convenience, please reach out to us directly at (888) 440-2468. We look forward to hearing from you. Best. – Annuity Gator Team

Annuity Gator

Hi Hartel – Thank you for your message. We would be happy to discuss some potential options with you. In order to provide you with the best advice, we would need to get a bit more information from you. Rather than emailing sensitive details back and forth, though, it would be best to chat via phone. Please feel free to reach out to us directly, toll-free, at (888) 440-2468. We look forward to speaking with you. Best. -AnnuityGator Team

Annuity Gator

Hi James – Thank you for your message. We would be happy to discuss some potential options with you with regard to determining which of these two companies would be best for you. In order to provide you with the best advice, we would need to get a bit more information from you. Rather than emailing sensitive details back and forth, though, it would be best to chat via phone. Please feel free to reach out to us directly, toll-free, at (888) 440-2468. We look forward to speaking with you. Best. -AnnuityGator Team

Annuity Gator

Hi Earl – Thank you for your message, and for checking out AnnuityGator.com. We would be happy to discuss your questions with you. Please feel free to reach out to us directly by phone, toll-free, at (888) 440-2468. Best. – Annuity Gator Team

Annuity Gator

Hi Ric – Thank you for your message, and for visiting out AnnuityGator.com website. We are always adding new annuity reviews and information to the site, so please feel free to check back often. Best. – Annuity Gator Team

Annuity Gator

Hi Richard – Thank you for your message. We would be happy to discuss some potential options with you. In order to provide you with the best advice, we would need to get a bit more information from you. Rather than emailing sensitive details back and forth, though, it would be best to chat via phone. Please feel free to reach out to us directly, toll-free, at (888) 440-2468. We look forward to speaking with you. Best. -AnnuityGator Team

Annuity Gator

Hi Jean – Thank you for your message. We would be happy to discuss some potential options with you. In order to provide you with the best advice, we would need to get a bit more information from you. Rather than emailing sensitive details back and forth, though, it would be best to chat via phone. Please feel free to reach out to us directly, toll-free, at (888) 440-2468. We look forward to speaking with you. Best. -AnnuityGator Team

Annuity Gator

Hi Kathy – Thank you for your message. We would be happy to discuss some potential options with you. In order to provide you with the best advice, we would need to get a bit more information from you. Rather than emailing sensitive details back and forth, though, it would be best to chat via phone. Please feel free to reach out to us directly, toll-free, at (888) 440-2468. We look forward to speaking with you. Best. -AnnuityGator Team

Annuity Gator

Hi Frank – Thank you for your message. We would be happy to discuss some potential options with you. In order to provide you with the best advice, we would need to get a bit more information from you. Rather than emailing sensitive details back and forth, though, it would be best to chat via phone. Please feel free to reach out to us directly, toll-free, at (888) 440-2468. We look forward to speaking with you. Best. -AnnuityGator Team

Annuity Gator

Hi Janet – Thank you for your message. We would be happy to discuss some potential options with you. In order to provide you with the best advice, we would need to get a bit more information from you. Rather than emailing sensitive details back and forth, though, it would be best to chat via phone. Please feel free to reach out to us directly, toll-free, at (888) 440-2468. We look forward to speaking with you. Best. -AnnuityGator Team

Annuity Gator

Hi Doug – Thank you for your message. We would be happy to discuss some potential options with you. In order to provide you with the best advice, we would need to get a bit more information from you. Rather than emailing sensitive details back and forth, though, it would be best to chat via phone. Please feel free to reach out to us directly, toll-free, at (888) 440-2468. We look forward to speaking with you. Best. -AnnuityGator Team

Annuity Gator

Hi Tongia – Thank you for visiting our AnnuityGator.come website. We are happy that you found the information valuable. We have recently added a number of new and updated annuity reviews to the site, so please feel free to check back again soon. Best. – Annuity Gator Team

Annuity Gator

Hi Bob – Thank you for your message, and we apologize for the technical difficulties that you had with getting the booklet. We have recently made some updates to our site – and also added additional annuity information – so please feel free to check back with AnnuityGator.com for our annuity guide, as well as additional details. If we can answer any questions for you, you can also reach our team of annuity “geeks” by calling us directly at (888) 440-2468. Best. – Annuity Gator Team

Annuity Gator

Hi Kurt – Thank you for your message, and we apologize for the technical difficulties that you had with getting the booklet. We have recently made some updates to our site – and also added additional annuity information – so please feel free to check back with AnnuityGator.com for our annuity guide, as well as additional details. If we can answer any questions for you, you can also reach our team of annuity “geeks” by calling us directly at (888) 440-2468. Best. – Annuity Gator Team

Annuity Gator

Hi Ali – Thank you for your message, and we apologize for the technical difficulties that you had with getting the booklet. We have recently made some updates to our site – and also added additional annuity information – so please feel free to check back with AnnuityGator.com for our annuity guide, as well as additional details. If we can answer any questions for you, you can also reach our team of annuity “geeks” by calling us directly at (888) 440-2468. Best. – Annuity Gator Team

David

I would like to keep up with info on American Equity company.

Annuity Gator

Hi David – Thank you for your message. At this time, we have several American Equity annuity reviews posted on our AnnuityGator.com website, including the Foundation Gold Annuity with Income Rider LIBR 6%, the Bonus Gold annuity, the Choice 10 Fixed Index annuity, and Foundation Gold annuity. We are always looking for suggestions for additional annuities to review, so will add more American Equity products to our list. Please check back soon for more reviews / updated information. Best. – Annuity Gator Team

Annuity Gator

Hi – Thank you for your message. We have recently updated our review of the American Equity Bonus Gold annuity, so at your convenience, please feel free to visit our AnnuityGator.com site again for the free annuity e-book. If we can help further, please reach out to us directly, toll-free, at (888) 440-2468. Best. – Annuity Gator Team

Annuity Gator

Hi Bruce – Thank you for your message. We have been in the process of updating (and adding to) our AnnuityGator.com website. So, please feel free to check back on the site at your convenience. If we can assist you further with any annuity information, we can also be reached directly, toll-free, at (888) 440-2468. Best. – Annuity Gator Team

Annuity Gator

Hi Wayne – Thank you for your message. We have recently been in the process of updating and adding to our AnnuityGator.com website – including an update of the American Equity Bonus Gold annuity. We would be happy to chat with you about the Vanguard account, pension, etc. In order to provide you with the best advice, though, it would be best to do so via phone (rather than emailing personal information back and forth). Please contact us at your convenience, toll-free, by calling (888) 440-2468. Thanks, we look forward to hearing from you. Best. – Annuity Gator Team

Annuity Gator

Hi Jim – Thank you for your message. We would be happy to discuss with you. In order to provide you with the best advice, though, we would need to get a bit more information from you. Rather than sending personal data back and forth via email, however, it would be better to chat via phone. Please feel free to reach out to us directly, toll-free, by calling (888) 440-2468. Thanks, we look forward to hearing from you. Best. – Annuity Gator Team

Annuity Gator

Hi David – Thank you for your message. We are always adding new, and updating the current, annuity reviews on the AnnuityGator.com site, so please feel free to check back often in order to keep up with American Equity, as well as other annuity companies and their products. If you have any questions that you would like to discuss with our experts, we can be reached directly, toll-free, by calling us at (888) 440-2468. Best. – Annuity Gator Team

Greg

Were do find the video to watch in American Equity -Bonus Gold

Annuity Gator

Hi Greg – Thank you for your comment. In some instances, our annuity reviews do not have an accompanying video. This is the case with the American Equity Bonus Gold. We do, however, have some additional links that you can find at the bottom of the review that will take you to more in-depth information. Please let us know if we can help with any additional information. We can be reached, toll-free, at (888) 440-2468, and through our secure online contact form at http://www.annuitygator.com/contact/. Best! The Annuity Gator

john

This review was well written, but as an owner of American Equity Retirement Gold, I have something to add. I regret the day, I believed my agent Craig, and parted with two-thirds of my 401k. What a sad day it was, if I had left it in the Thrift Savings Plan, I would have over $800,000 right now.

I have the SAME AMERICAN EQUITY FUND, I have news for those who have this fund and think they can pass it on to their kids, there ISN’T GOING TO BE ANY MONEY LEFT TO PASS ON to your WIFE and KIDS once they subtract all the Ryder Money you’ve used from the Actual Cash Value of your fund. You see? TO CONFUSE YOU, so you don’t get a lawyer and sue them, AMERICAN EQUITY SENDS YOU TWO VALUES that your fund is worth. There is the RYDER VALUE (which grows 7% a year) and the CONTRACT CASH VALUE (WHICH HARDLY GROWS AT ALL) Because they’ve stacked the deck against you) of the same fund. Both have TWO DIFFERENT VALUES so you think that you’re actually making money when you are really not. The Fund that has the SMALLEST AMOUNT is your Contract value which you get to pass onto your kids. The value of the Ryder though, which continues to grow 7 percent a year and has nothing to do with stocks, is only paid to you, it is NOT paid to your children. The ACTUAL CASH FUND (minus any stiff 12 percent surrender fees) and is based on stocks MAKES NO MONEY FOR YOU. I’ll explain why later.

Once you start accepting payments, that money is subtracted from the CONTRACT Value (the only value that it is really worth anything). If you paid them a $100,000 contract and you take out $4,000 a month. in two years time, you will only have $4000 left (of the original 100,000) to pass onto your kids. Your RYDER VALUE (lets say its worth $200,000 will never run out of money while you are alive, but unfortunately that’s not the money you pass onto your kids. If you pass on in five years, all that money is gone. And I didn’t even mention another disadvantage they give you, their Stiff ONE PERCENT annual FEES of the total contract that they take out of your cash value every year to make additional money on you. What we have all done is, in effect, to buy a reverse life insurance policy, except we paid the big money, our life’s savings, up front.

Think I’m kidding. I have had American Equity Retirement Gold since 2013 when I gave the agent, Craig Shepard, who cared more about about his 9% fee, which he never disclosed when I asked him (he took almost $18000 out of my $200,000. It is five years later, and I haven’t made a single penny. The stock market is up 46% since then, but my fund which is based on the S&P500 hasn’t made anything, because they only give you 1.5% a month, no matter how high the market rises. If the market rises 12% in March, you only get 1.5% gain. If the market doesn’t rise in April, you make nothing. But, and this is huge, if the market LOSES 12% in ONE MONTH, unlike when the market rises, AE actually subtracts the entire 12% LOSS from your PORTFOLIO. The Feburary 2018 Correction lost 8.54% and the entire 8.54% IS DEDUCTED from your 2018 portfolio which means you have almost no chance of making any money this year. It doesn’t matter if the S&P500 RISES 10 percent, you may not make anything. You would have been better off staying in S&P500 ETF in your company’s 401k, but my agent Craig doesn’t make any money if I keep it in there so he played on my fears of being a senior citizen of ending up thrown out of a nursing home for non-payment so I finally gave him two-thirds of my entire 401k because he promised me I would never run out of money as long as American Equity doesn’t go bankrupt. Another possibility.

The Market is up 36.42% since I bought this fund. Yet, I have made less than 1.5%, minus their (one Percent yearly fees). I have almost the same amount of money now as when I started, and I HAVEN’T EVEN STARTED TAKING RETIREMENT PAYMENTS YET. Once I do that, no money will be left for my heirs. MY RETIREMENT DREAMS of sailing on the Pacific are ruined because of the Ridiculous Surrender fees which I was never told about and because Craig Shepard thought more of benefiting himself than he did me. You need to take a long hard look and call American Equity about the real value of your fund before you make claims that you will give it to your children.

After years of AMERICAN EQUITY Customer Service explaining it to me, I found out that they have STACKED THE CARDS AGAINST ALL THEIR CUSTOMERS so all the ACTUAL CASH VALUE is ALREADY TAKEN OUT before it goes to your heirs, to make AE Executive CHAIRMAN, D.E. NOBLE, a BILLIONARE and you have nothing left after you die. What AMERICAN EQUITY HAS DONE is to MAKE MONEY for the SALES AGENTS (up to 9% of your TOTAL LIFE SAVINGS), so he will convince you through LIES, promises that can’t be kept, to PART WITH YOUR LIFE’S SAVINGS, which, once you hand it over to AE, you will never be able to get out in a hurry (only 10 percent a year). Think about it! American Equity has taken your RETIREMENT MONEY, WHEN WE ARE SO CLOSE TO RETIREMENT, and made that MONEY ILLIQUID, so you can’t use it if you want to have a pacemaker or heart transplant. They did this, not to make their customers money, but to make money for themselves, but Make ALMOST NOTHING FOR THEIR CUSTOMERS.

God bless the reviewer of this fund for telling the truth. I only wish I read it before I gave them my hard earned money. But THE REST OF YOU who read this, IT IS NOT TOO LATE TO KEEP YOUR MONEY out of the hands of American Equity. Fire your agent for suggesting this fund in the first place, expose him on your blogs, so others are alerted, which he is selling you because it BENEFITS HIM him first, and it doesn’t take care of you at all.

If I had to do it all over again, I would GLADLY PAY $10,000 FEE to a financial advisor, like the reviewer here, to put me in a fund which benefits me, unlike the MAJORITY OF AMERICAN EQUITY PRODUCTS WHICH BENEFIT THEMSELVES AND GET THE AGENT TO TALK YOU INTO TAKING THIS SCAM IN THE FIRST PLACE. Yes, it is a scam, when you sell a fund like this with a lot of hidden rules, but don’t tell the customer about the rules until after you have our money, and when you charge us a huge surrender fee that still costs us 9% of our entire cash value, after I have had the fund for five years and the surrender fee has only lowered from 12.5% (the original year I bought it, five years ago) to 9% today, it’s a SCAM because nobody IN THEIR RIGHT MIND WOULD TAKE THEIR MONEY OUT OF THEIR 401K where they are already making on average 10% a year, and buy this crap when there are so much better retirement strategies out there. I could have made yourself a bond ladder and gotten six percent a year on this money.

btw, does anyone know of a good securities lawyer in Boston to contact to sue these people and my agent Craig? American Equity already has several CLASS ACTION LAWSUIT AGAINST THEM for duping seniors in several states. American Equity Investors Get Nod On Fraud Settlements. READ this here http://www.law360.com/articles/473167/american-equity-investors-get-nod-on-fraud-settlements. This is how honest American Equity is with their customers.

Please let me know about a good securities lawyer in Boston.

It looks like another lawsuit could be pending. All you need is one peed-off customer to sue them, and make headlines, and ALL THE OTHER CUSTOMERS WILL FOLLOW SUIT. I have already, just yesterday, sent a letter to Senator Elizabeth Warren to warn her of what American Equity has done to me and others.

Annuity Gator

Hi John – Thank you for your post, and sorry to hear about your ordeal with American Equity. You are correct that it is so important to know all of the details before purchasing an annuity (or any financial product), as there can be many “moving parts” – and the products are not always what they are initially presented to be. While we don’t know any attorneys in Boston, we would be happy to answer any questions or concerns that you may have regarding this and / or other annuities. All the best. Annuity Gator Team

Annuity Gator

Clark, Thank you for your comment. Insurance companies are always changing their bonuses and rates to attract new customers. We stay on top of the changes daily, so it is best to set a time to chat with us and we can give you the latest rates and bonuses. To do this, you can give us a call at 888-440-2468 or by visit http://annuitygator.com/contact/